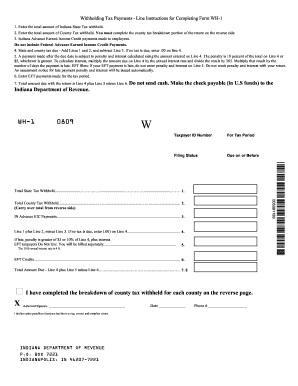

Get Withholding Tax Payments - Line Instructions For Completing Form Wh-1 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Withholding Tax Payments - Line Instructions For Completing Form WH-1 online

This guide provides clear instructions on filling out the Withholding Tax Payments - Line Instructions For Completing Form WH-1 online. Whether you are a user with little experience in legal documentation or just seeking assistance, this walkthrough aims to simplify the process for you.

Follow the steps to complete the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the total amount of Indiana State Tax withheld in the designated field.

- Input the total amount of County Tax withheld. Remember to complete the county tax breakdown portion of the return on the reverse side of the form.

- Record Indiana Advance Earned Income Credit payments made to employees. Ensure you do not include Federal Advance Earned Income Credit payments.

- Calculate state and county tax due by adding Lines 1 and 2, then subtracting Line 3. If no tax is due, enter .00 on Line 4.

- Be aware that a payment made after the due date incurs a penalty and interest, based on the amount on Line 4.

- For penalty calculations, apply 10 percent of the total on Line 4 or $5, whichever is greater. For interest, multiply the amount due on Line 4 by the annual interest rate and divide by 365, then multiply that result by the number of days the payment is late.

- If you are an EFT filer and your payment is late, do not enter penalty and interest on Line 5. An assessment notice for late payment will be issued automatically.

- Enter EFT payments made for the specific tax period in the allotted space.

- To determine the total amount due with the return, sum Line 4 and Line 5, then subtract Line 6.

- Make sure not to send cash. Instead, make your check payable in U.S. funds to the Indiana Department of Revenue.

- Finally, review all entries, save your changes, then download, print, or share the filled-out form as required.

Complete your Withholding Tax Payments online today for a streamlined filing experience.

To avoid withholding tax, employees can adjust their W-4 or WH-4 forms to accurately reflect their withholding allowances. This ensures that the correct amount of tax is withheld from their paychecks, potentially reducing the withholding burden. Additionally, careful tax planning and consulting with tax professionals can offer personalized strategies for minimizing withholding tax obligations. Always keep in mind the relevant Line Instructions For Completing Form WH-1 to stay compliant.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.