Loading

Get Ira Withdrawal Authorization Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ira Withdrawal Authorization Form online

Filling out the Ira Withdrawal Authorization Form online can seem daunting, but this guide will make the process simpler and more manageable. Whether you are looking to withdraw funds from your traditional or SIMPLE IRA, this step-by-step guide will help you complete the form accurately and confidently.

Follow the steps to complete your Ira Withdrawal Authorization Form online.

- Click the 'Get Form' button to obtain the form and open it in your preferred online editor.

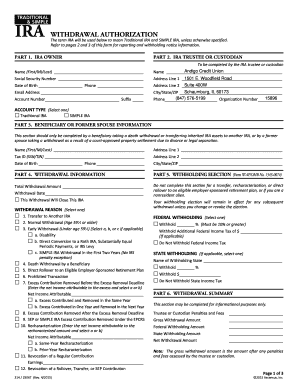

- In Part 1, enter the details of the IRA owner, which includes the full name, social security number, date of birth, phone number, email address, and account number. Ensure this information is accurate for processing your requests.

- Move to Part 2, where you will provide the name of the IRA trustee or custodian. In this section, Andigo Credit Union is indicated as the default. Include the full address and phone number for the trustee or custodian.

- Proceed to Part 3 to fill out the beneficiary or former spouse information if applicable. This section is necessary for those withdrawing as beneficiaries or due to divorce settlements. Add the name, address, tax ID, date of birth, and contact details.

- In Part 4, specify the withdrawal information, including the total amount you wish to withdraw and the desired withdrawal date. Indicate if you plan to close the IRA with this withdrawal.

- Part 5 requires you to make withholding elections. Select whether you wish to withhold federal income tax, if so, specify the percentage or total amount you want withheld.

- In Part 6, complete the withdrawal summary. This section provides an overview of penalties, fees, and the net amount you will receive after withholding.

- Part 7 delves into the withdrawal instructions. Here, detail the assets you wish to withdraw, along with the respective amounts. Include payment method details for cash, check, internal account, or external account.

- Finally, in Part 8, sign and date the document. Ensure you have accurately filled out all parts and that the signature is provided as necessary. If there is a notary or signature guarantee required by the custodian, include that as well.

Ready to proceed? Complete your Ira Withdrawal Authorization Form online today.

To obtain the 5329 form, you can easily visit the IRS website. Downloading the form from their site is a straightforward process. Simply search for the ‘5329 form’ on the IRS forms section. Once you have the form, you can fill it out as you prepare your IRA Withdrawal Authorization Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.