Loading

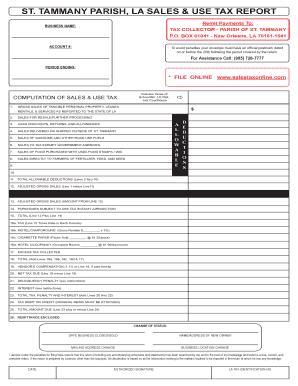

Get St Tammany Parish La Sales Use Tax Report 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ST Tammany Parish LA sales use tax report online

Completing the ST Tammany Parish LA Sales Use Tax Report online is a straightforward process that ensures compliance with local tax regulations. This guide provides step-by-step instructions to help you accurately fill out each section of the report.

Follow the steps to complete your report with ease.

- Press the ‘Get Form’ button to obtain the form and open it in your editing interface.

- Begin by filling in your business name and account number in the designated fields. Ensure that the information is accurate and corresponds to your official records.

- Indicate the period ending date for the tax reporting period you are submitting. This date is crucial for ensuring your report is processed for the correct timeframe.

- In the computation of sales and use tax section, enter your gross sales of tangible personal property, leases, rentals, and services as reported to the State of Louisiana in the appropriate field.

- Deduct any sales for resale or further processing by listing them in the corresponding field. Maintain documentation to validate these deductions, such as tax registration certificates.

- Account for cash discounts, returns, and allowances. List these in the fields designated for deductions to ensure accuracy.

- Include sales delivered or shipped outside of St. Tammany and any applicable sales of gasoline and other road-use fuels in the respective fields.

- If applicable, enter any sales to tax-exempt government agencies and sales of food purchased with USDA food stamps or WIC in the appropriate sections.

- List purchases subject to use tax in each jurisdiction. This includes any items purchased for your business use for which sales tax was not previously paid.

- Complete the total allowable deductions and adjusted gross sales calculations by following the instructions provided, ensuring each field reflects accurate figures.

- After you have filled out all necessary fields and double-checked your entries for accuracy, you can proceed to save your changes.

- Finally, download, print, or share the completed form based on your needs. Ensure you maintain a copy for your records.

Complete your ST Tammany Parish LA sales use tax report online today to ensure timely and accurate filing.

You can file Louisiana sales tax through the Louisiana Department of Revenue's website or in person at local offices. Businesses operating within St Tammany Parish should include the local sales tax in their filings. Utilizing the ST TAMMANY PARISH LA SALES USE TAX REPORT can streamline your process and ensure you are meeting all filing requirements effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.