Loading

Get Schedule 141

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule 141 online

Filling out the Schedule 141 is a crucial step in the corporation's tax return process. This guide provides a clear and comprehensive breakdown of each section, ensuring that users can complete the form accurately and with confidence.

Follow the steps to successfully complete the Schedule 141.

- Click ‘Get Form’ button to access the Schedule 141 and open it in your preferred editing environment.

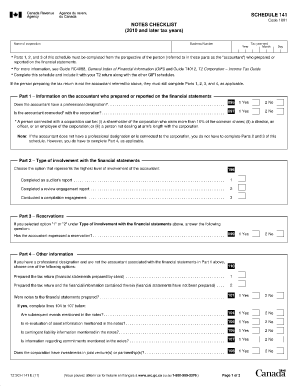

- Begin with Part 1, which requires you to provide information about the accountant who prepared the financial statements. Indicate if the accountant is connected with the corporation and whether they have a professional designation by selecting 'Yes' or 'No' for each question.

- Proceed to Part 2, where you will choose the highest level of involvement the accountant had with the financial statements. Select between completing an auditor's report, a review engagement report, or a compilation engagement.

- If you selected option '1' or '2' in Part 2, answer the reservations questions in Part 3 by selecting 'Yes' or 'No' for each of the statements regarding reservations expressed by the accountant.

- Review all entered information for accuracy. Ensure that all parts are completed as required, especially for connections and qualifications of the accountant. Double-check any attachments that may be necessary for your T2 return.

- Once satisfied with the information, you can save the form, download it as a PDF, print for records, or share as needed to complete the filing process.

Complete your Schedule 141 online today and streamline your corporation's tax return process.

Whether you need to submit Schedule 1 depends on your specific tax situation. Schedule 1 is often required for individuals who claim certain deductions and credits. If you are unsure, it's a good idea to consult a tax professional or explore resources on US Legal Forms to better understand how Schedule 141 interacts with other forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.