Loading

Get U43 Formular 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the U43 Formular online

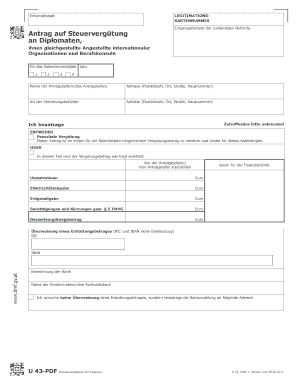

The U43 Formular is an essential document for users seeking tax reimbursement related to international organizations and diplomatic employees. This guide provides clear, step-by-step instructions to help you successfully complete the form online.

Follow the steps to complete the U43 Formular online effectively.

- Click the ‘Get Form’ button to obtain the U43 Formular and open it in your online editor.

- Fill in the LEGITIMATIONSKARTENNUMMER, which is your legitimacy card number.

- Indicate the Entsendestaat, or the sending state you are representing.

- Provide the Eingangsstempel der zuständigen Behörde, which refers to the entry stamp from the relevant authority.

- In the Antrag auf Steuervergütung section, state your name and address, ensuring to include your postal code, city, street, and house number.

- Select the type of representative authority by marking the appropriate box.

- In the section that asks for your request, indicate whether you are applying for a flat-rate refund or if the reimbursement amount will be calculated differently.

- Fill in the specific amounts under Umsatzsteuer, Elektrizitätsabgabe, and Erdgasabgabe, ensuring all numerical values are listed in Euros.

- Calculate the Gesamtvergütungsbetrag, or total reimbursement amount, and ensure it is filled correctly.

- Provide your bank details, including BIC and IBAN, if you wish for the refund to be transferred directly to your account.

- If you prefer a cash payment, indicate the address to which the cash payment should be sent.

- Review the declarations at the bottom carefully and confirm your understanding by signing and dating it.

- The representative authority must complete their section and add the relevant information, confirmation, and signature.

- Once all sections are filled out, you can save changes, download, print, or share the completed form as needed.

Start completing your U43 Formular online today!

International students can file a tax return by first determining their residency status and gathering essential documents like W-2 forms and 1042-S forms. Utilizing the U43 Formular on U.S. Legal Forms simplifies this entire process. It provides tailored guidance, making it easier for students to understand their obligations and file correctly, ensuring compliance with U.S. tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.