Loading

Get Itr 2 Form Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ITR 2 Form PDF online

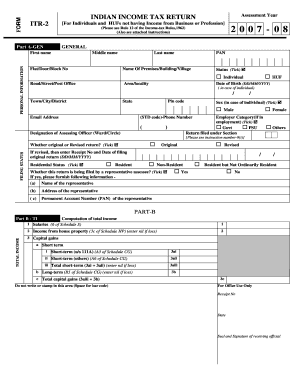

The ITR 2 Form is designed for individuals and Hindu Undivided Families (HUFs) who do not have income from business or profession. This guide will provide you with a step-by-step approach to complete this form online, ensuring that you fill it out accurately and efficiently.

Follow the steps to complete your ITR 2 Form online.

- Click the 'Get Form' button to download the ITR 2 Form PDF. Once downloaded, open the form in a suitable editor for online filling.

- Begin with Part A-GEN where you will enter your general personal information, including your first name, middle name, last name, date of birth, gender, and Permanent Account Number (PAN). Ensure all details are accurate.

- Indicate your filing status by selecting whether this is an original or revised return. If it is a revised return, provide the receipt number and date of filing for the original return.

- Proceed to Part B, where you will compute your total income. Start with salaries, followed by income from house property, capital gains, and income from other sources. Fill out corresponding schedules for each income head as needed.

- Calculate your total income by aggregating all figures from previous sections. Ensure that all applicable deductions under Chapter VI-A are accounted for to derive your final total income.

- After computing your total income, calculate your tax liability in Part B-TTI. This includes applying applicable tax rates, calculating surcharges, education cess, and claiming any tax relief.

- Complete the verification section at the end of the form. Affirm that the information provided is accurate and includes your signature or the signature of your representative if applicable.

- Finally, review the entire form for accuracy before saving your changes. You can download, print, or share the completed form as needed.

Complete your ITR 2 Form online today for a smooth filing experience.

Related links form

In TurboTax, attaching a PDF to your tax return involves navigating to the section where you can add documents. Choose the option to upload files, select your ITR 2 Form PDF, and ensure it is linked to your return correctly. This feature streamlines the submission process and keeps everything organized.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.