Get Statement Of Payment Received 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Statement Of Payment Received online

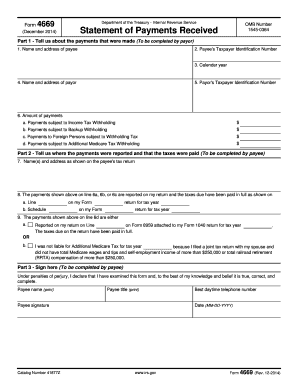

The Statement Of Payment Received is an important document used to report and confirm payments made, ensuring compliance with tax obligations. This guide will provide you with clear, step-by-step instructions on how to fill out this form online, making the process straightforward for all users.

Follow the steps to complete the Statement Of Payment Received online

- Press the ‘Get Form’ button to access the document and open it in your preferred online editor.

- In Part 1, provide information about the payments made by filling in the name and address of the payee. Use the exact information as it appears on official documents.

- Enter the payee's Taxpayer Identification Number, which could be a Social Security number or Employer Identification Number, as applicable.

- Specify the calendar year for which the payments were made, ensuring accuracy for tax reporting.

- Fill in the name and address of the payor, similar to how the payee information was completed.

- Enter the payor's Taxpayer Identification Number.

- Detail the amount of payments made in the appropriate fields: a. Payments subject to Income Tax Withholding, b. Payments subject to Backup Withholding, c. Payments to Foreign Persons subject to Withholding Tax, and d. Payments subject to Additional Medicare Tax Withholding.

- In Part 2, provide the name(s) and address as shown on the payee's tax return.

- Indicate where the payments listed in Step 7 were reported on your returns. Fill in the necessary lines and schedules from your forms.

- Complete the statement regarding Additional Medicare Tax. You need to clarify if the payments were reported or if you were not liable, and provide the necessary details.

- In Part 3, sign the form, providing your name and title. Then, enter your best daytime telephone number and date of signing.

- Once you have filled out all sections, review the information for accuracy. After confirming all details are correct, you can save your changes, download, print, or share the completed form as needed.

Start completing your Statement Of Payment Received online today to ensure your tax compliance!

To request a refund, you need to use IRS Form 1040X, which is the Amended U.S. Individual Income Tax Return. This form allows you to make corrections to your previously filed tax returns. By completing this form accurately, you can ensure you receive your Statement Of Payment Received, which confirms the refund amount. For a smoother process, consider using the services available on US Legal Forms, which guide you through completing the necessary forms easily.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.