Get Joint Final Rule: Customer Identification Programs For Broker-dealers ... 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Joint Final Rule: Customer Identification Programs for Broker-Dealers online

This guide provides a clear and comprehensive approach to completing the Joint Final Rule form related to Customer Identification Programs for Broker-Dealers online. It ensures users, regardless of their legal knowledge, can effectively fill out and submit the required information accurately.

Follow the steps to successfully complete the form.

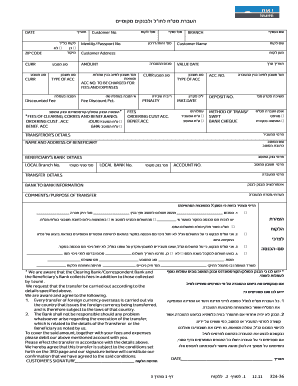

- Press the ‘Get Form’ button to access the form online and open it in the editor.

- Enter the branch name in the provided field, ensuring accurate spelling to avoid any processing delays.

- Fill in the customer's name and identification number, which may include a customer ID or passport number as applicable.

- Provide the customer's address along with the ZIP code for complete identification.

- Select the currency type for the transfer from the options provided.

- Specify the amount of the transfer in the designated field, ensuring compliance with your bank's transfer limits.

- Indicate the account number and details related to charges for this transfer, ensuring to select the appropriate type of account.

- Choose the payment method for the transfer (e.g., SWIFT or bank cheque) and check the corresponding box.

- If applicable, provide any relevant comments or the purpose of the transfer in the provided section.

- Review the declaration section, marking the appropriate boxes based on your situation regarding tax withholding.

- Finally, ensure that you sign and date the form as required. Once completed, you can choose to save changes, download, print, or share the form for submission.

Complete your forms online today for a seamless processing experience.

The FINRA requirements align with the Joint Final Rule: Customer Identification Programs for Broker-Dealers, mandating adherence to established identity verification protocols. These guidelines emphasize that member firms must have procedures in place to identify their customers before providing financial services. This requirement serves to enhance the overall security of the financial system and combat fraud. As a broker-dealer, aligning with these requirements can foster greater confidence among your clientele.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.