Get Form 3565

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3565 online

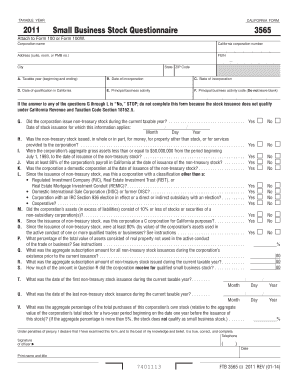

Filling out the Form 3565 online is a crucial step for corporations issuing qualified small business stock in California. This guide will provide you with comprehensive, step-by-step instructions to successfully complete the form, ensuring compliance with state regulations.

Follow the steps to fill out the Form 3565 online.

- Click 'Get Form' button to access the form and open it for editing.

- Begin by entering the corporation name and California corporation number in the designated fields. Ensure accuracy to avoid complications later in the filing process.

- Fill out the address of the corporation, including suite, room, or PMB number, if applicable. Follow it with the Federal Employer Identification Number (FEIN), city, state, and ZIP code.

- Complete section A by specifying the taxable year, including the beginning and ending dates.

- Provide the date of incorporation, state of incorporation, and the qualification date in California in their respective fields.

- Indicate the principal business activity and corresponding business activity code in section E and F, ensuring you use the appropriate six-digit code.

- Address questions G through L. If any questions in this section are answered 'No,' halt the completion of the form as the stock issuance may not qualify under California Revenue and Taxation Code Section 18152.5.

- If applicable, answer questions related to stock issuance, including the dates and amounts in sections M to U. Make sure to enter accurate figures for proper assessment.

- Complete the declaration at the bottom of the form. An authorized officer must sign, provide their title, and date the form.

- Once all fields are filled out correctly, you can save changes, download, print, or share the form as necessary for submission.

Take action now and complete your Form 3565 online to ensure compliance and benefit from the necessary tax provisions.

Filling out Form 15G step by step requires you to provide personal information such as your name and address, along with income details. Complete all sections regarding eligibility for tax exemption and submit the form to the bank or financial institution. For a clearer understanding, consulting Form 3565 can assist you in understanding compliance requirements. Always ensure you double-check for accuracy.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.