Get Kelly Services W4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kelly Services W4 online

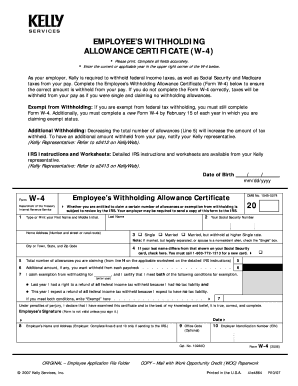

Filling out the Kelly Services W4 form accurately is essential to ensure the correct amount of federal taxes are withheld from your pay. This guide will walk you through each section of the form, providing clear and supportive instructions to help you successfully complete it online.

Follow the steps to accurately complete the Kelly Services W4 form.

- Click the ‘Get Form’ button to access the Kelly Services W4 form and open it in your preferred online editor.

- Enter the current or applicable year in the upper right corner of the form to provide a reference for your withholding allowances.

- Begin filling in your personal information. Type or print your first name, middle initial, and last name clearly in the designated fields.

- Complete your home address by providing the number and street or rural route, along with the city or town, state, and zip code.

- Input your Social Security number in the appropriate field to help identify your tax records.

- Select your filing status by checking the appropriate box for 'Single,' 'Married,' or 'Married, but withhold at higher single rate.' If your marital status requires special consideration, indicate that here.

- If your last name is different from what is shown on your Social Security card, check the box and be prepared to contact the Social Security Administration for a new card.

- Calculate and enter the total number of allowances you are claiming on Line 5, referring to the applicable IRS worksheet for guidance.

- If you want an additional amount withheld from each paycheck, specify that amount on Line 6.

- If you are claiming exemption from withholding, fill in Line 7 with the appropriate year and confirm you meet the conditions required for exemption.

- Sign and date the form at the bottom, as the form is not valid without your signature. Ensure all information is accurate and complete to the best of your knowledge.

- Finally, after reviewing all your entries, save your changes, download, print, or share the completed form as needed.

Complete your Kelly Services W4 online today to ensure the correct withholding for your pay.

Filling out the Georgia G4 form can be straightforward if you follow the instructions carefully. Begin by gathering necessary information such as your personal details and income estimates. Similar to the Kelly Services W4, you will declare your filing status and withholding allowances. If you find the process challenging, consider using uslegalforms, which provides templates and guidance to help you complete your G4 form accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.