Loading

Get Kra Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kra Form online

Filling out the Kra Form online is a necessary step for individuals and businesses looking to manage their tax obligations in an efficient manner. This guide will provide you with clear, step-by-step instructions to ensure a smooth completion process.

Follow the steps to complete the Kra Form online efficiently.

- Click ‘Get Form’ button to access the Kra Form and open it in your editor.

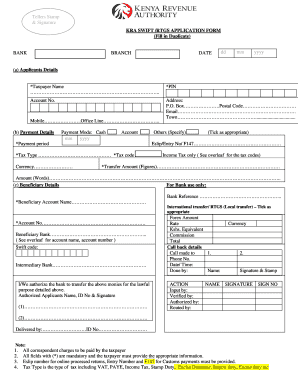

- Fill in the applicant's details including your taxpayer name, PIN, account number, address, email, town, mobile number, and office line. Ensure to complete all mandatory fields marked with an asterisk (*).

- Proceed to provide the payment details. Select your payment mode, indicate the payment period, and fill in the relevant tax type and tax code. Specify the transfer amount both in figures and words.

- In the beneficiary details section, complete the required information such as beneficiary account name, account number, and beneficiary bank details. Make sure to tick the appropriate option for international transfer or RTGS.

- Authorize the bank by providing the names and identification numbers of the authorized applicants along with their signatures.

- Review all the information you have entered to ensure accuracy. Correct any discrepancies before proceeding.

- Once satisfied, you can save the changes to the form, download it for your records, print a copy, or share it as necessary.

Take the next step and complete your documents online for a more convenient experience.

Filling the KRA form requires clear organization of your personal information and tax-related details. Start by entering your identification data, followed by listing your income sources and any applicable deductions. Paying attention to accuracy and detail will yield the best results on your completed KRA form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.