Get Rc65

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rc65 online

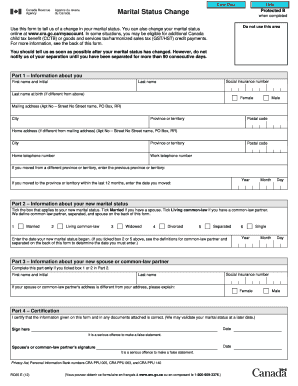

The Rc65 form is essential for reporting changes in your marital status. Completing this online form helps ensure that your personal information is updated efficiently and allows for potential adjustments to your benefits. This guide offers step-by-step instructions to assist you in filling out the form accurately.

Follow the steps to complete the Rc65 online form.

- Press the ‘Get Form’ button to download the Rc65 form and open it for editing.

- Begin by filling out Part 1, which requires your personal information. Enter your first name, last name, and initial, as well as your social insurance number. If your last name at birth differs, provide that information as well. Indicate your gender by selecting either 'Female' or 'Male'. Next, fill in your mailing address, including the apartment number, street number, street name, city, province or territory, and postal code. If your home address differs, provide that as well. Lastly, enter your home and work telephone numbers.

- In Part 2, indicate your new marital status by ticking the box that corresponds to your situation. You have options like married, living common-law, widowed, divorced, or separated. Ensure you fill in the date your marital status changed, using the format provided.

- If you selected married or living common-law, complete Part 3 with information about your new spouse or common-law partner. This includes their first name, last name, and social insurance number and their address if different from yours.

- In Part 4, you certify the information provided as correct. Sign and date the form, and if applicable, have your spouse or common-law partner sign as well. Be aware that providing false information is a serious offence.

- After completing all sections of the form, save your changes. You may also download, print, or share the completed form as necessary. Finally, ensure you send it to the appropriate tax centre as directed on the form.

Start completing your Rc65 online today to ensure your marital status is up-to-date.

Get form

To call Canada from abroad, you need to dial the international access code followed by the Canadian country code, which is 1. After this, add the area code and the local number. Keep in mind that the number format should follow North American standards. Using these steps can help you reach CRA or other Canadian contacts when you have RC65-related inquiries.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.