Get Pre Approval Certificate 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pre Approval Certificate online

Completing the Pre Approval Certificate online can streamline your home financing process. This guide will walk you through each section of the form to ensure you provide all necessary information accurately and confidently.

Follow the steps to fill out your Pre Approval Certificate efficiently.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

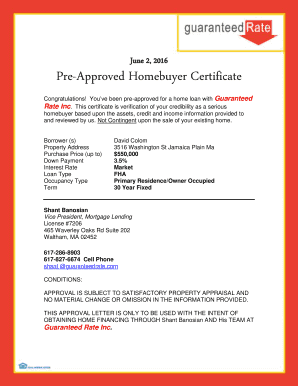

- Begin by filling out the 'Borrower(s)' section. Enter the full names of all individuals applying for the loan, ensuring that the spelling is accurate.

- Next, provide the 'Property Address' where you intend to purchase your new home. Include street name, city, and state.

- In the 'Purchase Price (up to)' field, indicate the maximum price you are willing to pay for the property. Ensure this aligns with your budget and financing options.

- Complete the 'Down Payment' field by specifying the amount you plan to pay upfront. This will impact your loan amount and monthly payments.

- Select the 'Loan Type' that fits your needs best. Options may include conventional, FHA, or VA loans. Consult with your lender if unsure which is right for you.

- Specify the 'Occupancy Type.' Indicate whether the property will be your primary residence, secondary residence, or an investment property.

- Fill in the 'Term' of the loan, typically expressed in years, such as 30 years fixed or 15 years. This determines how long you will be making payments.

- After completing all sections, review the information for accuracy. Ensure that there are no errors or omissions. Save your changes, then download, print, or share the completed form as needed.

Begin your journey to home ownership by completing your Pre Approval Certificate online today!

approval document is a formal statement from a lender that outlines how much they are willing to lend you based on your financial status. It requires you to submit various financial documents, such as income statements and credit information. This process offers you a clearer picture of your budget when searching for properties. Once approved, receiving your Pre Approval Certificate further solidifies your financial standing in the home market.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.