Loading

Get Procurement Missing Receipt Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Procurement Missing Receipt Form online

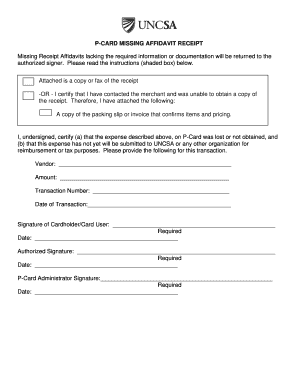

Completing the Procurement Missing Receipt Form is essential for documenting expenses when original receipts are unavailable. This guide will walk you through the process of filling out the form online, ensuring all necessary information is accurately provided.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the Procurement Missing Receipt Form and open it in your preferred online editor.

- Begin by reading any instructions provided on the form. This ensures that you understand all requirements before proceeding.

- In the first section, you will need to indicate if you have either attached a copy or fax of the receipt, or if you are certifying your inability to obtain one. Choose the appropriate option.

- If you have contacted the merchant, affirm this by checking the relevant box and attaching any alternative documents, such as a packing slip or invoice that verifies items and pricing.

- Next, complete the statement certifying the loss or absence of the receipt. This involves filling in details about the transaction, including vendor name, amount, transaction number, and date of transaction.

- Sign the form in the designated areas, ensuring you provide your name and date. If applicable, obtain the required signatures from the department head or any necessary parties.

- Lastly, review the completed form for accuracy and completeness before saving your changes. You can choose to download, print, or share the form as required.

Take the next step by completing your Procurement Missing Receipt Form online today.

To handle missing receipts effectively, begin by gathering any available transaction information. If you cannot retrieve a replacement receipt, fill out a Procurement Missing Receipt Form to document the loss. This proactive approach helps in maintaining accurate records and simplifies your expense submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.