Loading

Get Irs Form 8633 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8633 online

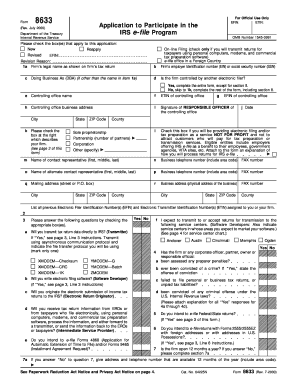

Filling out the IRS Form 8633 online is a crucial step for those applying to participate in the IRS e-file program. This guide provides step-by-step instructions to ensure users can complete the form accurately and efficiently.

Follow the steps to complete your IRS Form 8633 online.

- Click ‘Get Form’ button to access the form and open it in the designated application.

- Begin by checking the appropriate boxes that apply to your application, such as 'New', 'Reapply', or 'Revised'. If applicable, specify the reason for any revisions.

- Provide your firm’s legal name as shown on your firm's tax return in the field designated for that purpose.

- If your firm operates under a 'Doing Business As' (DBA) name, enter it in the appropriate section.

- If you are transmitting electronic returns using personal computers and tax preparation software, check the 'On-line Filing' box.

- Enter your firm’s Employer Identification Number (EIN) or Social Security Number (SSN) as required.

- Fill in the contact details for the responsible official of your firm, including name, business address, and telephone numbers.

- For the 'Principals of Your Firm or Organization' section, provide the required information for any individuals linked to your firm as specified.

- Complete the 'Applicant Agreement' section at the end of the form, verifying that all information is correct and complete.

- Once all fields are filled and reviewed, you can now save your changes, download a copy, print the form, or share it as needed.

Start filling out your IRS Form 8633 online today to ensure your participation in the e-file program.

Submitting FATCA details requires you to fill out IRS Form 8633 accurately. Make sure to attach all necessary documentation and submit it through the IRS's electronic filing system or by mail. For streamlined assistance, US Legal Forms offers resources that can guide you through this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.