Get Form 10b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 10b online

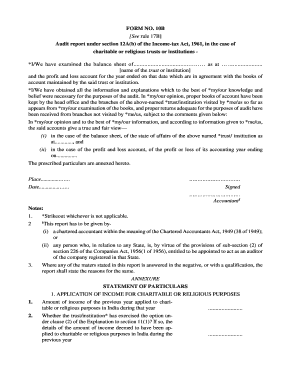

Filling out the Form 10b online is an important task for charitable or religious trusts or institutions to complete their audit report under the Income-tax Act, 1961. This guide will provide you with a comprehensive step-by-step approach to successfully filling out the form, ensuring clarity and compliance with the requirements.

Follow the steps to accurately complete Form 10b

- Click the ‘Get Form’ button to acquire the form and open it in the designated editor.

- Begin with entering the name of the trust or institution in the provided field. Ensure that the name is spelled accurately as it appears in official documents.

- Input the date of the balance sheet. This should reflect the specific date for which the financial review is being conducted.

- In this section, provide details concerning the accountant who has examined the financial records. This includes their name and credentials, confirming their eligibility according to the Chartered Accountants Act, 1949.

- Review and complete the annexure section. Here, you will provide information related to the application of income for charitable or religious purposes, and answer specific questions regarding income and property management as prescribed.

- Fill in the sections concerning the application or use of income or property, providing detailed accounts as prompted, ensuring you refer to any previous disclosures made in earlier submissions.

- Continuously verify the completeness and accuracy of the information entered in each section, readying for submission by saving or making necessary adjustments.

- Once complete, you can save changes, download the form for your records, or proceed to print it as required.

Complete your Form 10b online today to ensure your auditing process is efficient and compliant.

Form 10B is used primarily by eligible businesses to claim deductions under section 10B for export profits, whereas Form 10BB is for similar purposes but may apply to different provisions or eligibility criteria. Knowing the distinctions between these forms helps you file the correct paperwork for your specific situation. Platforms like US Legal Forms make understanding these differences clearer and easier.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.