Loading

Get Morgan Stanley Ira Distribution Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Morgan Stanley IRA Distribution Form online

This guide provides clear and detailed instructions for users looking to complete the Morgan Stanley IRA Distribution Form online. Each section will be carefully analyzed to help users accurately fill out the necessary information.

Follow the steps to successfully complete the Morgan Stanley IRA Distribution Form.

- Click ‘Get Form’ button to obtain the Morgan Stanley IRA Distribution Form and open it in the editor.

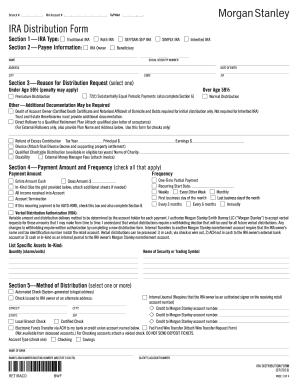

- In Section 1, indicate your IRA type by selecting one option: Traditional IRA, Roth IRA, SEP/SAR-SEP IRA, SIMPLE IRA, Inherited IRA, or Beneficiary.

- Section 2 requires Payee Information. Enter the following details for the IRA owner or beneficiary: name, social security number, date of birth, and address (including state, city, and ZIP code).

- In Section 3, select your reason for the distribution request from the options provided, such as under age 59½ or over age 59½, and provide any necessary documentation, depending on your choice.

- Move to Section 4 to specify the payment amount and frequency. Check all applicable options, indicating if you want the entire amount paid in cash, a one-time partial payment, or recurring payments.

- For Section 5, choose the method of distribution. Select one or more from the options, including automated check, internal journal transfer, or electronic funds transfer.

- If applicable, complete Section 6 regarding 72(t) substantially equal periodic payments, ensuring to select your distribution method.

- In Section 7, make a death benefit election, if necessary.

- Section 8 focuses on Required Minimum Distributions. Check your preferred frequency for withdrawals.

- Proceed to Sections 9 and 10 to make federal and state income tax withholding elections, respectively, ensuring to understand the implications of your choices.

- In Section 11, certify the information provided on the form by signing and dating it.

- If required, obtain the signature of a complex manager or qualified delegate in Section 12 for 72(t) distributions.

- Finally, review all sections for accuracy, then save your changes, download, print, or share the completed form as needed.

Start filling out your Morgan Stanley IRA Distribution Form online today to manage your retirement assets effectively.

Withdrawing from a Morgan Stanley IRA before the age of 59½ typically incurs a 10% early withdrawal penalty. Additionally, the withdrawn funds may be subject to ordinary income taxes. To avoid penalties, consider consulting with a tax professional to evaluate your specific situation. Understanding this can help you make informed decisions about your IRA distributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.