Loading

Get Nebraska Form6mb 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Form 6MB online

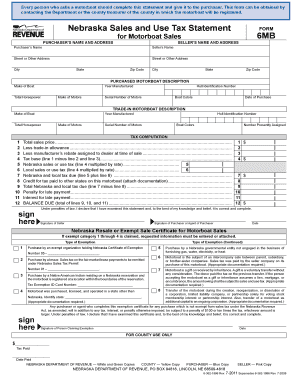

Nebraska Form 6MB is essential for individuals involved in the sale of motorboats. This guide provides clear instructions on how to complete the form online, ensuring all required information is accurately captured.

Follow the steps to fill out the Nebraska Form 6MB online.

- Click the ‘Get Form’ button to download the Nebraska Form 6MB and open it in your preferred online editor.

- Fill in the purchaser’s name and address in the designated fields. Ensure accuracy to prevent delays in processing.

- Next, enter the seller’s name and address, including street address, city, state, and zip code.

- Provide detailed information about the purchased motorboat including its make, year manufactured, total horsepower, make of motors, hull identification number, serial number of motors, boat colors, and date of purchase.

- If applicable, fill in details for the trade-in motorboat using the same fields as above for clarity.

- Move to the tax computation section. Begin by entering the total sales price, followed by the trade-in allowance and any manufacturer’s rebate assigned to the dealer.

- Calculate the tax base by subtracting the trade-in allowance and manufacturer’s rebate from the total sales price.

- Complete the sales or use tax by multiplying the tax base by the relevant tax rate for both Nebraska and local taxes.

- Add the Nebraska and local tax amounts together to find the total tax due, and apply any credits for tax paid to other states.

- Calculate any applicable penalty or interest for late payment, if necessary.

- Finally, declare the accuracy of the statement by signing as the seller and having the purchaser or their agent do the same. Enter the date of signing.

- Once all sections are completed, save the form, download it, print copies for your records, and share with necessary parties.

Complete your Nebraska Form 6MB online today to ensure a smooth transaction!

To calculate Nebraska sales tax, you need to multiply your taxable sales amount by the applicable tax rate, which includes both state and local rates. Keeping accurate records will help ensure your calculations are precise. Our platform offers calculators and charts that can aid in this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.