Get Form Rdt 121

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Rdt 121 online

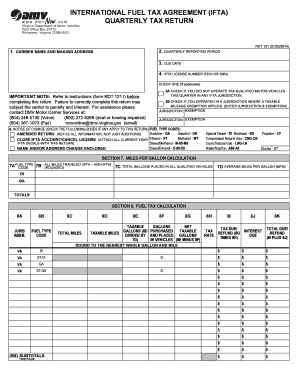

Filling out the Form Rdt 121 online can be a straightforward process if you follow the steps carefully. This guide will provide you with detailed instructions on how to complete each section of the form, ensuring that you remain compliant with the International Fuel Tax Agreement requirements.

Follow the steps to complete your online Form Rdt 121.

- Click ‘Get Form’ button to access the form and open it in your editor.

- Enter the carrier name and mailing address in the designated fields. Ensure accuracy as this information is crucial for correspondence.

- Input your IFTA license number, which may be your Federal Employer Identification Number (FEIN) or Social Security Number (SSN). Verify the number to avoid errors.

- Indicate the quarter for which you are reporting by checking the appropriate box for the quarterly reporting period.

- In section 5, confirm if you did not operate tax-qualified motor vehicles by checking the relevant box. If you operated in a jurisdiction with a taxable mileage exemption, enter the jurisdiction and exemption details.

- Fill out section 6 if there are any changes to report, including fuel type codes or name and address changes. Ensure that any necessary attachments are submitted.

- Move to section 7 to calculate the miles per gallon. Input the fuel type code and record the total miles traveled and total gallons placed in all qualified vehicles.

- Complete section 8 to calculate your fuel tax. Enter information regarding total miles and taxable gallons for each jurisdiction and fuel type code.

- Review the totals from sections 7 and 8 to ensure accuracy. This will include the net tax due and any potential refunds.

- Provide your credit card information if you are opting to pay electronically, ensuring all details are accurate. Authorize the DMV to charge the card.

- Sign and date the certification section, affirming that all information is true and complete. Include your contact information.

- After reviewing all entered information, save your changes, and download, print, or share the form as needed.

Complete your Form Rdt 121 online today to ensure compliance and timely processing.

Related links form

To obtain an IFTA sticker in Virginia, you first need to apply for an IFTA license through the state's DMV. After your application is approved, you will receive your IFTA stickers, which you must display on your vehicle. Ensuring compliance with Form Rdt 121 during this process is vital. For further details on acquiring IFTA stickers, the US Legal Forms platform can guide you effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.