Loading

Get Denver Sales Tax Return Monthly Department Of Finance ... - Denvergov 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Denver Sales Tax Return Monthly Department Of Finance online

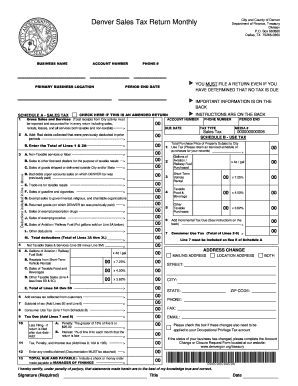

Filing the Denver Sales Tax Return is essential for businesses operating within the city. This guide provides a step-by-step approach to assist users in accurately completing the form online, ensuring compliance with local tax regulations.

Follow the steps to successfully complete your Denver Sales Tax Return.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Enter your business name in the designated field. Make sure the name matches your business registration.

- Input your account number in the appropriate section. This number is crucial for maintaining accurate records.

- Fill in the primary business location, including street, city, state, and zip code. This helps identify your business's operating area.

- Provide your phone number for any necessary contact regarding your submission.

- Indicate the period end date for which you are filing this return. Ensure that you are filing for the correct monthly period.

- Complete Schedule A by entering gross sales and services in the appropriate fields. Remember to report all receipts, both taxable and non-taxable.

- Fill out the deductions section by entering non-taxable sales, sales to other dealers, and other relevant deductions.

- Calculate the total tax due based on your sales data, using the prescribed rates for food, beverages, and other taxable purchases.

- Review the consumer use tax section if applicable, filling in details about any use tax owed based on untaxed purchases.

- If filing late, ensure you complete the penalty and interest sections as needed.

- After completing all sections, save your changes. You can then download, print, or share the form as needed.

Complete your Denver Sales Tax Return online today to ensure compliance and avoid penalties.

Colorado does not implement a Value Added Tax (VAT) like some other countries. Instead, it relies on sales tax for revenue generation. Understanding the differences between VAT and sales tax is essential for businesses operating within Colorado, particularly when preparing financial statements and conducting sales according to the Denver Sales Tax Return Monthly Department Of Finance ... - Denvergov guidelines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.