Loading

Get Car Loan Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Car Loan Application online

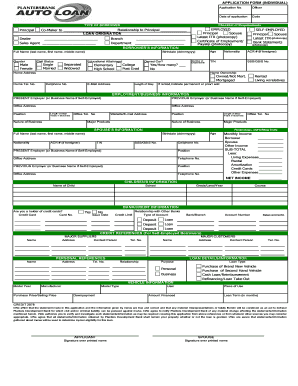

Filling out a car loan application online is a straightforward process that allows you to provide the necessary information for financing your vehicle. This guide will walk you through each step of the application form, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete your car loan application.

- Click ‘Get Form’ button to access the car loan application and open it in the editor.

- Begin by selecting your type of borrower: whether you are the principal borrower or an officer. Specify the date of application and include the application code.

- Complete the checklist of requirements for your employment status—either employed or self-employed. If employed, provide a photocopy of the latest income tax return and either a certificate of employment or payslip.

- For self-employed individuals, upload a photocopy of your latest income tax return and your bank statements.

- Fill in your personal information, including your full name, gender, civil status, number of dependents, and whether you own a car. Indicate your educational attainment and provide your age and birthdate.

- Provide your home address, nationality, tax identification number (TIN), and any applicable identification numbers if you are a foreigner.

- Enter your home ownership status, home telephone number, mobile number, email address, and length of stay at your current address.

- Complete your employment or business information, including the name and address of your present and previous employers or business, your position, office telephone number, and nature of business.

- If applicable, fill in the spouse's information similar to your own, as well as your financial information, detailing monthly income from all sources and deducting living expenses to calculate your net income.

- Provide details of any children, including their names, schools, and grades, if relevant.

- Complete the banking and credit information section, indicating whether you hold credit cards and detailing account information with banks, including balances and types of accounts.

- Discuss loan details, noting the purpose of the loan, type, vehicle information, and amounts for downpayment and financing.

- Review the statement affirming the accuracy of your information and provide your signature and that of your spouse, if applicable, in the designated areas.

- Once all fields are completed, save changes, and consider downloading, printing, or sharing the form as necessary.

Complete your car loan application online today for a seamless financing experience.

There's typically a minimum financing amount of $5,000 on subprime loans. Often, if you're looking for less than $5,000 and you have poor credit, a loan is difficult to come by.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.