Get Sd Tax Exempt Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sd Tax Exempt Form online

Completing the Sd Tax Exempt Form online is a straightforward process designed to allow users to claim exemption from sales tax efficiently. This guide will provide a step-by-step approach to ensure that you fill out the form accurately and comprehensively.

Follow the steps to fill out the Sd Tax Exempt Form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

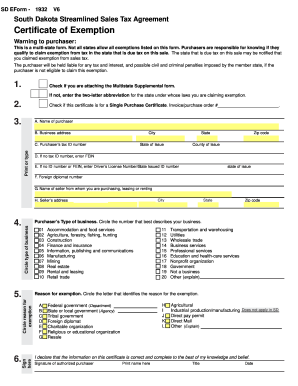

- Indicate if you are attaching the Multistate Supplemental form. If you are not attaching it, specify the two-letter postal abbreviation for the state under whose laws you are claiming an exemption.

- Fill in your information: Enter your name, business address, state of issue, tax ID number, and county of issue. If you do not have a tax ID number, provide your FEIN or driver’s license number.

- Describe the type of business by circling the number that best represents it. If none applies, circle ‘Other’ and provide an explanation.

- Specify the reason for exemption by circling the appropriate letter and providing any additional information requested. If none of the listed reasons apply, circle ‘M Other’ and explain.

- Provide your signature as an authorized purchaser, print your name, include your title and the date of signing.

- After completing the form, use the button at the end to print the form for mailing or save it to preserve your changes.

Complete your Sd Tax Exempt Form online today!

An exemption certificate, specifically the Sd Tax Exempt Form, is a document that allows certain organizations or individuals to avoid paying sales tax on qualifying purchases. This form serves as proof that the buyer is not liable for sales tax due to their exempt status. It’s important to understand that not all individuals or organizations qualify for this exemption. To ensure you have the correct form, it helps to consult local tax regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.