Loading

Get Form 11 Payslip

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 11 Payslip online

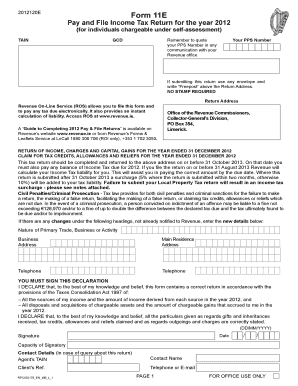

Filling out the Form 11 Payslip online can streamline your tax reporting process. This guide will provide comprehensive steps to navigate through each section of the form effectively.

Follow the steps to complete your Form 11 Payslip online.

- Click the ‘Get Form’ button to access the form and open it in your chosen editor.

- Enter your Personal Public Service Number (PPS Number) in the designated field. This is crucial for any communication with your Revenue office.

- Indicate your return address, ensuring it's correctly formatted to facilitate receipt by the Office of the Revenue Commissioners.

- For each income source, provide the required details in the relevant sections. This includes describing your trade or employment and entering amounts of income earned.

- Complete the section for tax credits, allowances, and reliefs. Make sure to enter accurate figures to reflect your financial situation.

- Fill out the declaration section, confirming the accuracy of your information by providing your signature and date.

- Review all entered information for accuracy before finalizing your form.

- Once all details are confirmed, save the changes, and proceed to download, print, or send the form as needed.

Complete your Form 11 Payslip online now for a timely and efficient tax filing experience.

Filing an income tax return for stock market earnings involves reporting your capital gains and losses accurately. Use Form 11 Payslip to document your income from trading activities. Make sure to categorize your income sources correctly and provide all necessary details. For ease, consider utilizing the uslegalforms platform, which guides you through completing your tax return with confidence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.