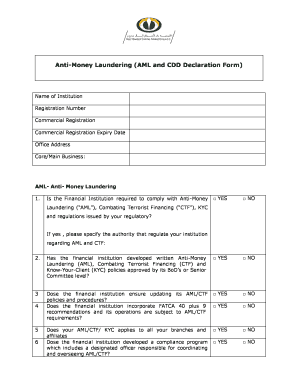

Get Om Gulf Baader Capital Markets Anti-money Laundering (aml And Cdd Declaration Form)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OM Gulf Baader Capital Markets Anti-Money Laundering (AML And CDD Declaration Form) online

Filling out the OM Gulf Baader Capital Markets Anti-Money Laundering (AML And CDD Declaration Form) is an important step in ensuring compliance with regulatory requirements. This guide will provide you with clear and detailed instructions on how to complete the form online, making the process easy to follow.

Follow the steps to complete the AML and CDD declaration form accurately

- Click the ‘Get Form’ button to obtain the form and open it in a suitable editor.

- Begin by entering the name of your institution in the designated field. Make sure to use the official name as registered.

- Input the registration number of your institution accurately.

- Fill in the commercial registration details, including the expiry date.

- Provide the office address where your institution is located.

- Specify the core or main business of your institution.

- Answer the questions regarding your compliance with Anti-Money Laundering regulations. This includes confirming whether your financial institution is required to comply with AML, CTF, and KYC regulations.

- If your institution is required to comply, indicate the regulatory authority governing your compliance.

- Confirm if the financial institution has developed and approved written policies related to AML, CTF, and KYC by its Board of Directors or Senior Committee.

- Indicate whether the financial institution regularly updates its AML/CTF policies, and whether it incorporates FATCA recommendations in its operations.

- List the designated officer responsible for coordinating AML/CTF if such a program exists, along with their contact information.

- Confirm if your financial institution has policies covering relationships with politically exposed persons (PEPs) and if it has procedures to avoid conducting transactions with shell banks.

- Provide answers about your institution's training programs regarding KYC, CTF, and AML, including whether training is provided regularly.

- Complete sections assessing your institution's risk assessment practices, internal audit functions, and enhanced due diligence for higher risk clients.

- Fill out the KYC section including details about stock exchange listings, correctness of client information, ongoing due diligence, and record-keeping practices.

- In the FATCA section, state whether your institution is registered with the IRS and provide your GIIN if applicable.

- Finally, ensure that you or an authorized representative sign the form and affix the company stamp where required. Review all entries for accuracy before finalizing.

Complete your documents online today to ensure compliance and streamline your processes.

KYC is designed to verify a customer's identity, financial profile and risk level, and CDD is the key to this process. Customer Due Diligence (CDD) means collecting and evaluating the new customers' information and determining their risk for illegal financial transactions. AML cannot work without KYC and CDD.

Fill OM Gulf Baader Capital Markets Anti-Money Laundering (AML And CDD Declaration Form)

Anti-Money Laundering and. Combating the Financing of. This threat is continually evolving. This Anti-Money Laundering and Counter Financing of Terrorism.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.