Get Fs4 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fs4 Form online

Completing the Fs4 Form online is a straightforward process that ensures accuracy in your tax records. This guide will walk you through each section, providing clear instructions that cater to users of all experience levels.

Follow the steps to successfully complete the Fs4 Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

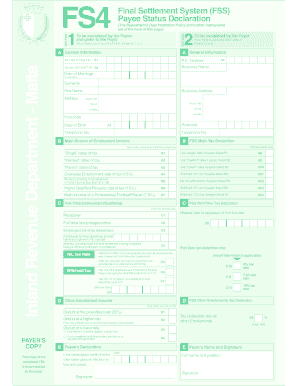

- Begin with Section A, General Information. Fill in your ID Card/IT Registration Number, P.E. Number, and your name. Include your business address and postcode. If applicable, also provide your spouse's ID Card/IT Number and the date of marriage.

- Next, proceed to fill out Part B, FSS Main Tax Deduction. Indicate your main source of emolument income by ticking the correct box according to your tax rate status—single, married, parent, overseas employment rate, exempt income, or specific professional rates.

- If applicable, explore Part C which focuses on FSS Part-Time Employment Tax Deduction. Select the appropriate box that describes your employment status, such as pensioner, full-time student, or employed full-time elsewhere. Make sure to provide your full-time employer’s P.E. number if required.

- Move on to Part D for FSS Other Emoluments Tax Deduction. You must choose between deducting at the prescribed rate or a higher rate for your other emolument income.

- Finally, complete Section E, Payer’s Name and Signature. This section also includes the payee’s declaration to certify that all information provided is correct. Ensure to include the full name, position, and the date of the declaration.

- After completing all sections, review your entries for accuracy. Once confirmed, you can save changes, download, print, or share the form as necessary.

Start filling out your Fs4 Form online today to ensure your tax information is accurate and up to date.

To file Form 3 and Form 4 effectively, start by reviewing the requirements for each form to ensure you meet all necessary criteria. Collect all relevant information and supporting documents before beginning to fill out the Fs4 Form. Submit your completed forms through the designated channels, whether online or via physical submission. If you need help, uslegalforms can provide templates and guidance to make the filing simpler and more efficient.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.