Loading

Get Sa370 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sa370 online

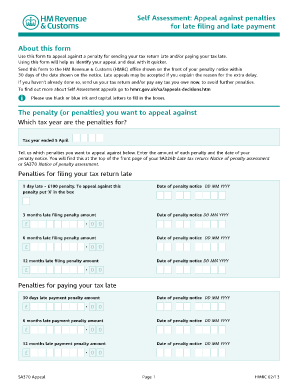

Filling out the Sa370 form online is essential for appealing against penalties related to late filing and late payment of your tax return. This guide will provide you with a step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the Sa370 appeal form online.

- Click the ‘Get Form’ button to obtain the Sa370 form and open it in your preferred online editor.

- Enter the details regarding the penalty you wish to appeal. Specify which tax year the penalties correspond to and mark the appropriate boxes for each penalty (e.g., 1 day late, 3 months late) along with the amounts owed.

- In the space provided, detail your reasons for the appeal. Clearly explain why you believe the penalty is unjust, such as meeting a deadline or having a reasonable excuse for the delay.

- Include any relevant dates and evidence that supports your claim, ensuring to provide as much detail as possible for clarity.

- Fill in your tax reference number as indicated on your penalty notice, and if available, provide your National Insurance number.

- Complete your personal information by entering your full name, address, and postcode. If you are signing on behalf of another individual, indicate your relationship to that person.

- Ensure to sign and date the appeal form. If your information differs from what you provided earlier, include it.

- Once all sections are filled out, review the form for accuracy and completeness. You can then save any changes made to the document.

- Finally, download and print the completed form to send to the HMRC office indicated on your penalty notice.

Complete your Sa370 form online today to address your penalty appeal promptly.

Filing for tax amnesty involves completing the appropriate forms, including the SA370, and submitting them along with any required documentation. Ensure that you follow all instructions and deadlines to qualify for amnesty benefits. Your prompt action can lead to significant savings on penalties and interest.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.