Loading

Get Bir Form 1902 Sample With Answer

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 1902 Sample With Answer online

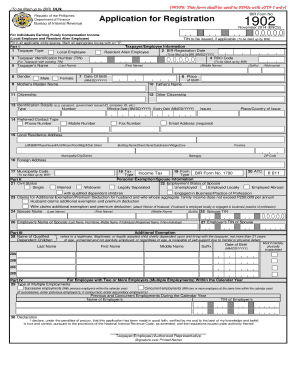

This guide provides step-by-step instructions for users on how to fill out the Bir Form 1902 Sample With Answer online. Intended for individuals earning purely compensation income, this document is essential for registration with the Bureau of Internal Revenue.

Follow the steps to complete the Bir Form 1902 online.

- Click 'Get Form' button to obtain the form and open it in your preferred online editing tool.

- Fill in all applicable white spaces in Part 1. Select your taxpayer type by marking the appropriate box: 'Local Employee' or 'Resident Alien Employee'. Enter your BIR registration date, which will be filled in by BIR, and your Taxpayer Identification Number (TIN).

- Continue with the personal information section. Fill in your full name, gender, date of birth, place of birth, mother's maiden name, father's name, citizenship, and any other citizenship. Provide identification details by specifying the type of ID, its number, effective date, and expiry date.

- Indicate your preferred contact method by filling in your phone number, mobile number, fax number, and email address.

- Complete your local residence address, including specific details such as lot number, building name, municipality, province, and zip code.

- If applicable, enter your foreign address and municipality code as directed.

- In Part II, indicate your civil status and provide related information, including your spouse's employment status and the names of qualified dependent children if any.

- For multiple employments, specify the type and provide details of employers, TINs, and the corresponding declaration.

- Review your information for accuracy. Ensure that all required fields are filled out and any necessary documentation is attached.

- Once complete, save your changes. You can then download, print, or share the completed form as necessary.

Complete your Bir Form 1902 online today to ensure your registration is processed smoothly.

BIR Form 1701 is the annual income tax return for self-employed individuals and professionals. This form allows individuals to report their earnings more comprehensively. Understanding the differences between BIR Form 1701 and other forms is crucial for accurate tax filing. Using a Bir Form 1902 Sample With Answer can provide clarity on how various forms operate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.