Loading

Get Form 982

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 982 online

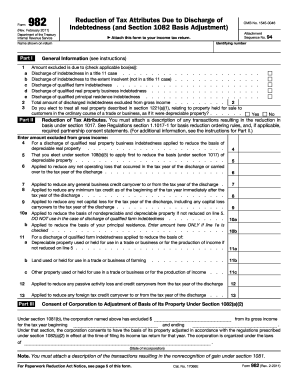

Filling out Form 982 is an important step for reporting the exclusion of discharged indebtedness from gross income. This guide provides a comprehensive overview and step-by-step instructions to help you complete the form accurately online.

Follow the steps to complete Form 982 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the identifying section, enter your name as shown on your income tax return and provide your identifying number.

- In Part I, select all applicable boxes to indicate the categories of indebtedness being discharged.

- Complete line 2 by entering the total amount of discharged indebtedness you qualify to exclude from gross income.

- If applicable, check the box on line 1 for real property treatment indicating if you elect to treat property as depreciable.

- In Part II, proceed to indicate the reduction of tax attributes based on the discharged amounts. Carefully follow the specific requirements for each line.

- Complete Part III if you are a corporation requiring consent for adjustment of basis under section 1082.

- Review all entries thoroughly, ensure accuracy, and save your changes.

- Once finished, download, print, or share the completed form as needed.

Complete your Form 982 online today to ensure proper tax reporting and compliance.

Proof of debt from a creditor is a document that substantiates the amount owed to them. This can include invoices, contracts, or even letters confirming the debt. Such documentation is vital for effective debt management and can be documented through Form 982 for formal proceedings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.