Loading

Get Hud 92900 B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hud 92900 B online

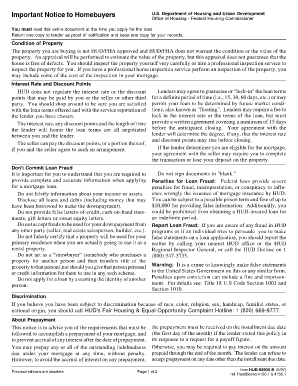

Filling out the Hud 92900 B form online is a crucial step in the mortgage application process. This guide provides clear and detailed instructions to help you complete each section accurately, ensuring you meet all necessary requirements.

Follow the steps to efficiently fill out the Hud 92900 B form.

- Click ‘Get Form’ button to obtain the Hud 92900 B form and open it in your preferred online editor.

- Begin by entering your personal information in the designated fields. This includes your name, address, and contact details. Ensure all information is accurate to avoid delays in processing your application.

- Proceed to fill in the property information. Provide the address of the property you are planning to purchase along with the purchase price. Make sure this information matches any documents submitted to your lender.

- Detail the loan information. This includes the type of loan you are applying for, the amount you wish to borrow, and related terms. Double-check your entries to confirm that they align with your lender’s requirements.

- Review the section for any disclosures. You may need to acknowledge specific terms regarding property condition, loan fraud, and discrimination. Read these carefully, as they outline important responsibilities and legal implications.

- Complete the acknowledgment section at the end of the form. You will need to sign and date the document to confirm that you have read and understood the information provided. Make sure your signature is clear.

- After thoroughly reviewing the completed form for any errors or omissions, you can save your changes. You may choose to download, print, or share the Hud 92900 B form as needed.

Take the next step in your mortgage journey by completing your Hud 92900 B form online today.

The identity of interest refers to a relationship between the borrower and the party providing the financing or selling the property. In FHA transactions, it’s important to disclose this relationship on the Hud 92900 B form to maintain transparency and minimize conflict of interest. Properly reporting identity of interest protects all parties involved and upholds FHA standards.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.