Loading

Get Td1sk 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Td1sk online

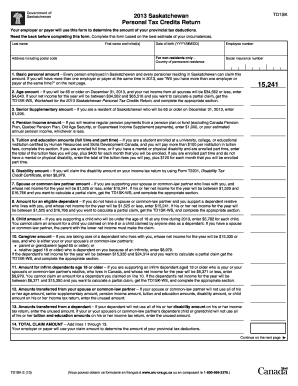

The Td1sk is a personal tax credits return used by employees and pensioners in Saskatchewan to determine provincial tax deductions. Completing this form accurately is essential for ensuring the correct amount of tax is deducted from your earnings.

Follow the steps to fill out the Td1sk effectively.

- Click the ‘Get Form’ button to access the Td1sk and open it in your chosen editor.

- Begin by entering your last name in the designated field, followed by your first name and initials. Ensure this information is accurate for proper identification.

- Provide your complete address, including the postal code, in the appropriate section of the form.

- Fill in your date of birth using the format YYYY/MM/DD to avoid discrepancies.

- If you have an employee number, enter it in the specified field. This is often provided by your employer.

- For non-residents, indicate your country of permanent residence, if applicable.

- Input your social insurance number. This is crucial for processing your tax information accurately.

- Proceed to claim your basic personal amount by entering the prescribed amount (15,241) in the corresponding line.

- If you will be 65 or older by December 31 of the tax year, assess your net income to determine your eligibility for the age amount and enter the appropriate figure.

- Continue down the list, filling in the amounts for any applicable claims such as senior supplementary amount, pension income amount, education amounts, and so forth, as outlined in the document.

- After completing all relevant sections, total your claims by adding lines 1 to 13 and enter this final claim amount in line 14.

- Review your form for any missed information or errors to ensure accuracy.

- Once satisfied, save your changes, and download, print, or share the form as necessary.

Complete your Td1sk form online today to ensure proper tax deductions!

The W-8BEN form is intended for non-US individuals who receive income from US sources, such as royalties or dividends. This form allows them to establish their foreign status and claim any benefits under applicable tax treaties. If you're unsure about the form, USLegalForms offers insights and resources, making it easier to address your Td1sk requirements while ensuring compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.