Get W 4v

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-4V online

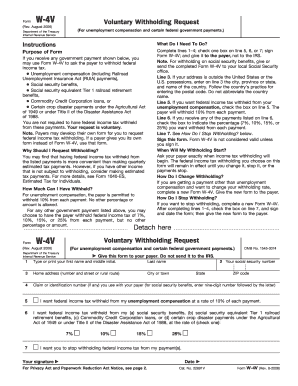

Form W-4V allows users to request federal income tax withholding from certain payments, including unemployment compensation and other federal government payments. This guide provides clear instructions to help you fill out this form accurately and efficiently online.

Follow the steps to complete the W-4V form online.

- Press the ‘Get Form’ button to access the W-4V form and open it in your chosen online editor.

- On line 1, type or print your first name and middle initial, followed by your last name in line 2.

- Provide your social security number on line 2. It is essential to include this information for processing.

- On line 3, enter your home address, including the street number, city or town, state, and ZIP code.

- If applicable, add your claim or identification number on line 4, especially if you use a specific number with your payer.

- On line 5, if you desire federal income tax withholding from your unemployment compensation, check the box to indicate a 10% withholding.

- On line 6, for additional government payments, check the box corresponding to the percentage you wish to withhold (options include 7%, 10%, 15%, or 25%).

- If you wish to stop withholding, check the box on line 7.

- Sign the form to validate it in the provided signature section and include the date.

- Once completed, save your changes, and then download, print, or share the form with the appropriate payer. Ensure you do not send it to the IRS.

Start filling out your W-4V form online today for convenient tax withholding management.

To account for withholding tax, you should keep track of the amounts withheld from each paycheck, as indicated on your payslip. The details from your W 4v help you understand how much is being taken out for federal taxation. Use this information to monitor your tax liability throughout the year, adjusting your W 4v if needed to ensure you are paying the right amount. For more support, consider using uslegalforms to access the right documents and resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.