Get V0105 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the V0105 online

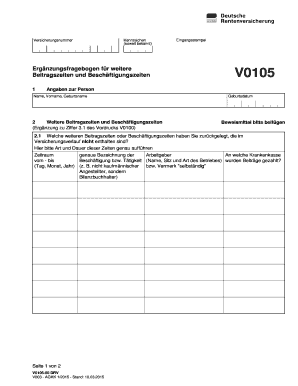

The V0105 form is essential for providing details about additional contribution and employment periods relevant to your social insurance. This guide will walk you through each section of the form to ensure you complete it accurately and effectively.

Follow the steps to fill out the V0105 form correctly.

- Click ‘Get Form’ button to access the V0105 form and open it for editing.

- Begin with the 'Personal Information' section. Enter your name, first name, and birth name as specified. Ensure that you provide accurate details to avoid any discrepancies.

- In the 'Additional Contribution and Employment Periods' section, detail any contributions or employment periods not listed in your insurance history. Be thorough by specifying the type and duration of these periods.

- List the employer for each employment period noted, including the name, location, and type of business operation where contributions were made. This may include non-commercial roles, such as freelance or self-employed activities.

- For each entry, indicate the insurance provider and the specific time frame during which contributions were made, using precise dates (day, month, year) in the specified format.

- Complete the 'Additional Information Regarding Insurance Relationship' section, providing any other relevant information as required by the form.

- Lastly, confirm the accuracy of your personal status data and any attached documents required for support. Make sure to assist your application with all necessary proofs.

- After verifying all information, save your changes, download the completed form, print a copy for your records, or share it if needed.

Start filling out the V0105 form online today to ensure your contributions are accurately recorded.

When you leave Germany, your pension rights generally remain intact, and you can often claim your pension later, even from abroad. It is essential to inform the German Pension Insurance about your departure and address any taxes or regulations that may apply. You can also decide to transfer your pension to a different country, depending on the agreements in place. For detailed guidance, consider consulting the resources available on the USLegalForms platform.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.