Loading

Get Taxpayer Registration Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxpayer Registration Form online

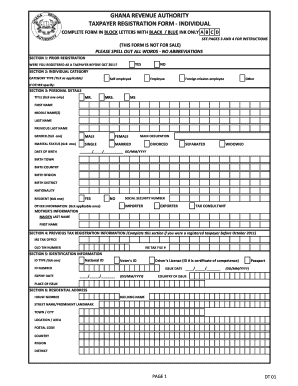

Completing the Taxpayer Registration Form online is a crucial step for individuals looking to register as taxpayers. This guide provides a clear step-by-step approach to help users accurately navigate and fill out the form effectively.

Follow the steps to easily fill out the Taxpayer Registration Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review Section 1, which pertains to prior registration. Indicate if you were registered as a taxpayer before October 2011 by ticking 'Yes' or 'No'.

- Move to Section 2, the individual category. Choose the appropriate category that applies to you; options include self-employed, employee, foreign mission employee, or other (specify if necessary).

- In Section 3, fill in your personal details. Begin with your title, followed by your first name, middle name(s), last name, and previous last name if applicable. Indicate your gender and marital status, then provide your date of birth in the format DD/MM/YYYY, followed by your birth details (town, country, region, and district).

- Specify your nationality and residency status by confirming whether you are a resident or not. Tick all other applicable information such as social security number, importer, exporter, or tax consultant.

- If you were previously registered, complete Section 4 with your IRS tax office, old TIN number, and IRS tax file number.

- Proceed to Section 5 to provide identification information. Choose your ID type, fill in the ID number, issue date, and expiry date, along with the country and place of issue.

- In Section 6, input your residential address using block letters. Include your house number, building name, street name, town/city, location/area, postal code, country, region, and district.

- Section 7 requires you to provide your postal address details. Indicate if you use a P.O. Box, PMB, or DTD. Fill in your postal number and respective location information.

- For Section 8, provide your contact method. Include phone/landline numbers, mobile numbers, fax numbers, email, and website. Indicate the preferred contact method by ticking one of the options.

- If you are self-employed, complete Section 9 with your business details, including nature of business, turnover, number of employees, and any registered business names along with their addresses.

- In Section 10, the declaration section, ensure you state that the information provided is correct. Sign and date the form, or use your thumbprint in the presence of a registration officer.

- Review all sections to ensure accuracy. Once completed, save your changes, and you may download, print, or share the Taxpayer Registration Form as needed.

Start completing your Taxpayer Registration Form online today to ensure your compliance.

Yes, obtaining a Taxpayer Registration Number is essential when purchasing a house in Jamaica. The TRN is necessary for various property transactions, ensuring that you comply with tax obligations. You can easily get your TRN by filling out the Taxpayer Registration Form. Having a TRN also benefits you in other legal and financial processes in Jamaica.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.