Get P46

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P46 online

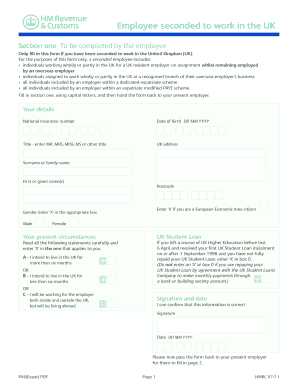

The P46 form is essential for individuals who have been seconded to work in the United Kingdom. This guide provides clear instructions on how to accurately complete the form online, ensuring compliance and proper submission.

Follow the steps to successfully complete the P46 form.

- Press the ‘Get Form’ button to obtain the P46 form and open it for editing.

- In section one, fill in your personal details using capital letters. This includes your National Insurance number, date of birth (DD MM YYYY), title (MR, MRS, MISS, MS, or other), UK address, surname, first name(s), postcode, and an 'X' if you are a European Economic Area citizen. Mark your gender with an 'X' in the appropriate box.

- Indicate your present circumstances by reading the statements carefully and entering ‘X’ in the box that applies to you regarding your UK Student Loan status. Choose one option among A, B, or C.

- Sign and date the form in the designated area to confirm that the information you provided is correct. Use the format DD MM YYYY for the date.

- Once completed, return the form to your current employer for section two to be filled out.

- The employer will complete section two by entering the employment details, including the date the employment started in the UK, payroll number, job title, and necessary tax codes. Ensure that all details are accurate before submission.

- Finally, the employer should submit the completed form to HM Revenue & Customs on the first payday or as required.

Start completing your P46 form online today for a smooth submission process.

To answer the HMRC starter checklist, begin by gathering your personal information, such as your National Insurance number and previous tax codes. Each section of the checklist relates to your employment status, with P46 coming into play for tax code determination. Be diligent about providing accurate and up-to-date information to avoid complications with your taxes later. If you need help, consider using uslegalforms to find resources that simplify this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.