Get Irs Forms 3498a 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Forms 3498a online

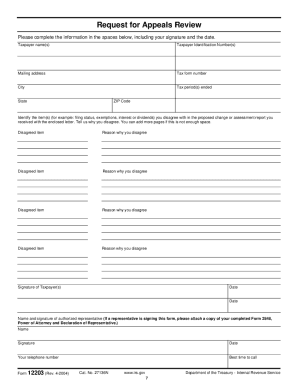

Filling out the Irs Forms 3498a online can be a straightforward process when you know how to approach each section. This guide provides a step-by-step breakdown of the form to ensure accurate completion and compliance with regulations.

Follow the steps to complete the Irs Forms 3498a online effectively.

- Click ‘Get Form’ button to obtain the form and open it in your browser or desired editor.

- Enter your personal information, including your name, taxpayer identification number, and mailing address, in the designated fields.

- Input the tax form number you are submitting and the tax period that corresponds to your filing.

- Detail any items you disagree with from the proposed changes and provide a clear explanation for each disagreement in the specified area.

- Review your form for accuracy and completeness before final submission.

- Once satisfied, you can save changes, download, print, or share the completed form through your preferred method.

Begin filling out the Irs Forms 3498a online today to ensure timely compliance with your tax obligations.

You need form 8821 if you want to authorize someone to receive your tax information from the IRS without assigning them decision-making powers. This form is particularly beneficial when you want to keep your financial affairs private while allowing a trusted individual access to pertinent records. By utilizing IRS Forms 3498A, you can enhance your understanding of your rights and responsibilities in relation to tax matters.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.