Loading

Get Iht406 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht406 online

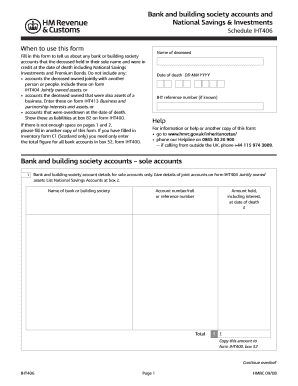

Filling out the Iht406 form is a crucial step in reporting the financial assets of a deceased individual. This guide will provide clear instructions on how to accurately fill out this form online to ensure a smooth process.

Follow the steps to complete the Iht406 form accurately.

- Press the ‘Get Form’ button to access the Iht406 form and view it on your device.

- Begin by entering the name of the deceased and the date of death in the specified fields at the top of the form. Make sure to use the correct format for the date (DD MM YYYY).

- Locate the section for bank and building society accounts. Provide details for each sole account by listing the name of the bank or building society, account number or reference number, and the amount held, including interest, at the date of death. Record the total amount and copy it to form IHT400, box 52.

- Next, complete the National Savings Accounts section by specifying the type of account, account number, and the amount held at the date of death. Add these amounts together for the total in box 2.

- Fill out the Premium Bonds section by entering the bond number, bond value at the date of death, and any unclaimed or uncashed prizes. Calculate the total by adding the bond value and any unclaimed prizes together.

- If you have other National Savings & Investments products, provide the name of the product, certificate number, and the amount held at the date of death. Calculate and record the total for this section.

- Finally, ensure that all totals are completed accurately. The total for National Savings & Investments should be copied to form IHT400, box 54. Review all entries for accuracy before saving your changes or downloading the completed form.

- After completing the Iht406, save the changes, and use options available to either download, print, or share the form as necessary.

Ensure that you complete your Iht406 form online for a hassle-free experience.

A 10IEA filing requires submitting the form to the appropriate IRS office. Before filing, ensure that all details are filled in correctly to avoid issues later. Using Uslegalforms can significantly ease this process, providing templates and step-by-step instructions to ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.