Get 1040x Fillable 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1040X Fillable online

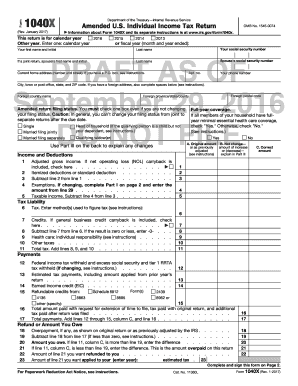

The 1040X Fillable form is used for amending your U.S. Individual Income Tax Return. Understanding how to properly fill out each section is crucial for ensuring your changes are accurately processed by the IRS. This guide offers step-by-step instructions to simplify the process for all users, regardless of their prior experience with tax forms.

Follow the steps to successfully complete the 1040X Fillable form online.

- Press the ‘Get Form’ button to acquire the 1040X Fillable form and open it in your chosen digital editor.

- Begin by entering your personal information at the top of the form including your first name, middle initial, last name, and social security number.

- If filing jointly, additionally provide your partner's name and social security number.

- Fill in your current home address, including city, state, and ZIP code. If you have a foreign address, complete the relevant sections.

- Select your amended return filing status by checking the appropriate box, even if it remains unchanged.

- Indicate any adjustments to your adjusted gross income by completing the income and deductions section, detailing original amounts, net changes, and the correct amounts.

- Calculate your tax liability by providing the necessary details on tax amounts, credits, and any other applicable taxes.

- Complete the payments section by entering total amounts withheld, estimated payments, and other relevant information.

- In the refund or amount you owe section, accurately indicate any overpayments or amounts owed.

- If there are changes to exemptions, complete Part I and provide the correct number and amounts.

- In Part III, provide a clear explanation for your amendments and attach any supporting documents.

- Finally, ensure all signatories complete the signature section and provide the date.

- Once all sections are completed, save your changes, and print or download the completed form for your records.

Start completing your 1040X Fillable online today to amend your tax return efficiently.

No, the 1040 and 1040NR are not the same. The 1040 is designed for residents, while the 1040NR is specifically for non-residents. It's important to use the correct form for your status, as it affects your tax liability and filing requirements. When in doubt, refer to the 1040X Fillable form to amend and clarify your situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.