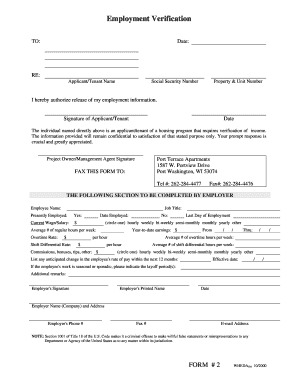

Get Ahtc Form 400, Employment Verification. Wheda Section 42 Compliance Manual 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AHTC Form 400, Employment Verification. WHEDA Section 42 Compliance Manual online

How to fill out and sign AHTC Form 400, Employment Verification. WHEDA Section 42 Compliance Manual online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Legal, tax, corporate along with other digital documents require a heightened level of adherence to regulations and safeguarding.

Our templates are routinely refreshed in line with the most recent legal modifications. Additionally, when you work with us, all the information you input in your AHTC Form 400, Employment Confirmation. WHEDA Section 42 Compliance Handbook is shielded against loss or damage via superior file encryption.

Our platform empowers you to complete the entire process of filling out legal documents online. As a result, you save time (if not days or even weeks) and avoid unnecessary fees. From this moment forward, complete AHTC Form 400, Employment Verification. WHEDA Section 42 Compliance Handbook from your residence, workplace, or even while on the go.

- Access the file in the advanced online editing software by clicking Get form.

- Fill in the fields highlighted in yellow.

- Click the green arrow labeled Next to advance from one box to another.

- Utilize the e-signature feature to affix an electronic signature on the document.

- Enter the applicable date.

- Review the entire document to confirm that you haven’t overlooked anything.

- Click Done and save your updated form.

How to modify Get AHTC Form 400, Employment Verification.

WHEDA Section 42 Compliance Manual 2020: personalize forms digitally.

Streamline your document preparation process and tailor it to your specifications within moments. Finalize and validate Get AHTC Form 400, Employment Verification. WHEDA Section 42 Compliance Manual 2020 using a powerful yet user-friendly online editor.

Drafting documents is often challenging, particularly when you only manage it occasionally. It necessitates strict adherence to all regulations and the accurate completion of all sections with comprehensive and exact information. However, it frequently happens that you need to modify the form or add additional sections to complete. If you need to refine Get AHTC Form 400, Employment Verification. WHEDA Section 42 Compliance Manual 2020 prior to submission, the easiest way to do this is by utilizing our robust yet straightforward online editing tools.

This all-inclusive PDF editing tool enables you to swiftly and effortlessly complete legal documents from any device connected to the internet, make straightforward edits to the template, and insert extra fillable areas. The service permits you to designate a specific section for each type of data, such as Name, Signature, Currency, and SSN, etc. You can make these fields required or conditional and decide who should fill out each field by assigning them to a specified recipient.

Our editor is a versatile, feature-rich online tool that can assist you in swiftly and easily customizing Get AHTC Form 400, Employment Verification. WHEDA Section 42 Compliance Manual 2020 as well as other forms according to your requirements. Reduce document preparation and submission time and ensure your forms appear professional without complications.

- Access the desired file from the directory.

- Complete the blanks with Text and utilize Check and Cross tools for the checkboxes.

- Use the right-side panel to alter the form with new fillable sections.

- Select the sections according to the type of data you wish to collect.

- Designate these fields as mandatory, optional, or conditional and customize their sequence.

- Assign each section to a specific individual using the Add Signer tool.

- Verify that all necessary changes have been made and click Done.

Income Limits for Section 8 Housing in Wisconsin Income LimitsVery Low Income (50% of Median)Low Income (80% of Median)1 Person$26,850$42,9502 People$30,650$49,0503 People$34,450$55,2004 People$38,200$61,3002 more rows • Mar 28, 2023

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.