Get The Sind Professions Trades Callings And - Sindhlaws Gov 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the THE SIND PROFESSIONS TRADES CALLINGS AND - Sindhlaws Gov online

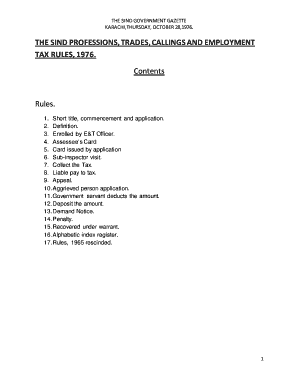

Filling out the 'The Sind Professions Trades Callings and Employment Tax Rules, 1976' form online is a straightforward process. This guide provides clear and thorough instructions to help users complete each section of the form accurately.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by reviewing the definitions provided in the rules. Understanding terms such as 'business' and 'tax' will help you fill out the form accurately.

- Fill out Form PCT-1, the Survey Register, which requires your name, nature and title of business, exact address, initials, and rate of tax. Ensure that all information is correct before proceeding.

- If you receive Form PCT-2, which is the notice for filing a declaration, complete Form PCT-3, declaring whether you were assessed to income tax during the previous financial year or if you do not carry on the business subject to this tax.

- Once you are assessed, you will receive an assessee's card (Form PCT-5). Ensure the card is displayed in a visible location at your business premises as required.

- If applicable, submit Form PCT-6 to inform the District Excise and Taxation Officer of the commencement of a new business or if you have ceased to be liable for tax.

- Make sure to make any required payments according to the instructions provided, using Form PCT-8 for tax payments.

- Keep track of notices such as Form PCT-9, Demand Notices, and respond accordingly to avoid any penalties.

- Finally, review your completed forms for accuracy, save the changes, and either download, print, or share the form as needed.

Complete your documents online today to ensure compliance and avoid any penalties.

A professional tax certificate in Pakistan is a document that confirms an individual's compliance with local professional tax requirements. Issued by local tax authorities, this certificate highlights the individual's payment status and can be pivotal for both professional and personal financial matters. For assistance, consider exploring resources like USLegalForms, which can help guide you in obtaining necessary documentation under THE SIND PROFESSIONS TRADES CALLINGS AND - Sindhlaws Gov.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.