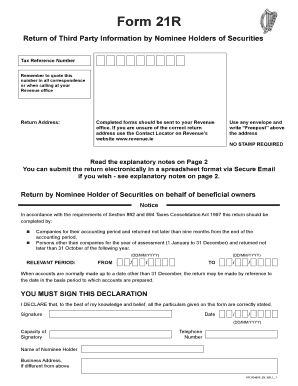

Get Form 21r - Return Of Third Party Information By Nominee Holders Of ... - Revenue 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 21R - Return Of Third Party Information By Nominee Holders Of ... - Revenue online

Filling out the Form 21R is essential for nominee holders of securities to accurately report third party information. This guide provides a clear and comprehensive approach to assist users in completing the form online, ensuring compliance with tax regulations.

Follow the steps to accurately complete the Form 21R online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Tax Reference Number in the specified field. Ensure this number is included in all correspondence or when contacting your Revenue office.

- Fill in the return address where completed forms should be sent. If unsure, refer to the Contact Locator for the correct address.

- Indicate whether the return is made by a company or an individual. Remember that companies must submit the return within nine months of the accounting period, while individuals must do so by October 31 of the following year.

- Provide the relevant period for the securities, including the start and end date in DD/MM/YYYY format.

- Sign the declaration to confirm that all particulars on the form are correct. Include the date of signing.

- Input the capacity of the signatory, their telephone number, and the name of the nominee holder. If applicable, provide a different business address.

- Complete the details regarding the beneficial owners of the securities, including their name, first name (if applicable), and address.

- List the nominal value and class of securities held, as well as the number of securities.

- Record the name of the company, government, or other body that issued the securities.

- Document the registration dates of the securities in your name using the DD/MM/YYYY format.

- After ensuring all information is filled correctly, submit the form electronically or save, download, print, or share the completed form as required.

Take the next step to file your documents online and ensure compliance with tax regulations.

Form 46G is a declaration form that provides important information relating to income received, which aids in calculating tax responsibilities. It is designed to gather essential data for annual tax assessments. Completing Form 46G accurately is vital, as it ties directly into the requirements of Form 21R - Return Of Third Party Information By Nominee Holders Of ... - Revenue, ensuring comprehensive compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.