Loading

Get Bir Form 1700 Editable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir Form 1700 Editable online

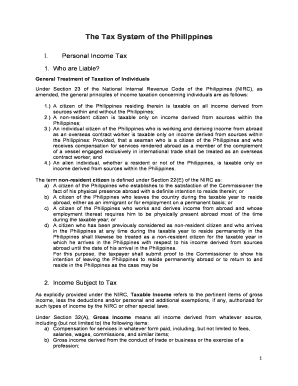

This guide provides a clear and comprehensive approach to filling out the Bir Form 1700 Editable online. Designed for a wide range of users, including those with minimal legal experience, this process will help ensure accurate submission of the required information for personal income tax in the Philippines.

Follow the steps to effectively complete the Bir Form 1700 Editable online.

- Press the ‘Get Form’ button to access the form, and open it in the editor.

- Carefully review the form and begin with your personal information. Enter your full name, address, and taxpayer identification number (TIN) as requested.

- Proceed to the income section of the form. You will need to provide details of your total earnings from all sources, including compensation and business income.

- Next, indicate any allowable deductions. Depending on your situation, you may need to choose between itemized or optional standard deductions. Fill in the relevant amounts.

- Complete the section on personal and additional exemptions. This will require information about dependents and applicable exemptions based on your filing status.

- Calculate your taxable income by subtracting deductions and exemptions from your total income, and ensure the accuracy of your calculations.

- In the tax computation section, apply the appropriate tax rate to your net taxable income. This will determine your income tax due.

- Once all sections are completed, review the form for any errors. Make necessary corrections to ensure accurate information.

- Finally, save your changes. You may download, print, or share the completed form as needed.

Complete your tax documents online with confidence and accuracy!

To create BIR Form 2307 in Excel, start by designing the layout to match the official form's fields. Input the necessary data into the cells, ensuring clarity and accuracy. Once your form is complete, save it as a PDF for submission. Using Excel can simplify the data entry process while maintaining the integrity of your records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.