Loading

Get Sc Form 1605

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC Form 1605 online

Filling out the SC Form 1605 is essential for managing your quarterly tax returns accurately. This guide offers step-by-step instructions to help you complete the form online with confidence and ease.

Follow the steps to complete your SC Form 1605 online.

- Press the ‘Get Form’ button to obtain the SC Form 1605 and open it for editing.

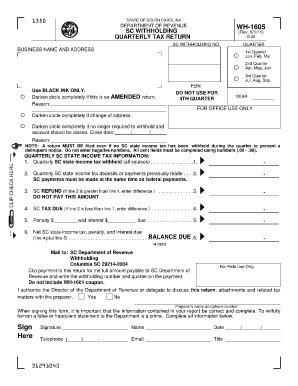

- Begin by entering the business name and address at the top of the form. Ensure you also fill in your SC withholding number, federal employer identification number (FEIN), and the year of filing.

- Indicate the quarter for which you are filing by darkening the appropriate circle. Complete the corresponding year field.

- On Line 1, enter the total amount of SC state income tax withheld from all sources during the quarter.

- On Line 2, enter the total amount of SC state income tax deposits or payments you previously made.

- If applicable, enter the amount on Line 3 for the SC refund if Line 2 is greater than Line 1.

- On Line 4, enter the SC tax due if Line 2 is less than Line 1, reflecting the difference.

- On Line 5, indicate any penalties due, if applicable.

- Calculate the total on Line 6, which includes the net SC state income tax, penalties, and interest due.

- Ensure all fields are neatly completed using black ink, with no alterations. Do not staple any attachments.

- Include your contact phone number, and ensure the form is signed by an authorized individual.

- Once the form is fully completed, save your changes and proceed to download or print the document for submission.

- Finally, clip any payment to the return and ensure you write the withholding number and quarter on the payment.

Start filling out your SC Form 1605 online to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Anyone who earns income in South Carolina may need to file a state income tax return, depending on their filing status and income level. If your income exceeds the state-established thresholds, you must file. Using SC Form 1605 can be a helpful guide in determining your filing requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.