Loading

Get Eitc Checklist Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the EITC Checklist Form online

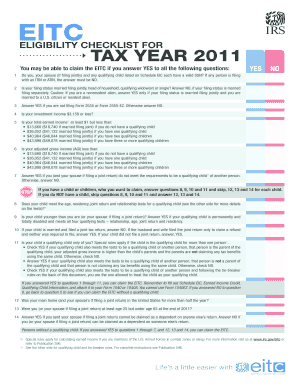

Filling out the EITC Checklist Form online is a straightforward process that helps determine your eligibility for the Earned Income Tax Credit. This guide provides step-by-step instructions to ensure you complete the form accurately and with ease.

Follow the steps to complete the EITC Checklist Form online.

- Press the ‘Get Form’ button to access the EITC Checklist Form and open it in your document editor.

- Begin with the screening section by answering the first seven questions regarding social security numbers, filing status, and income limits, ensuring that all responses align with your personal situation.

- If you have children, proceed to answer questions eight to eleven, which will ascertain if your child meets the criteria to be considered a qualifying child for the credit.

- If you do not have qualifying children, skip to questions twelve to fourteen and provide answers that reflect your living situation and age requirements.

- Review all your answers to ensure accuracy and compliance with the EITC eligibility criteria outlined in the form.

- Once you have completed the form, you can save your changes, download a copy, print it, or share it as needed.

Start completing the EITC Checklist Form online today to determine your eligibility for the Earned Income Tax Credit.

Question 15 on form 8867 requires tax preparers to affirm that they have examined all relevant documents and information regarding the client's eligibility for the Earned Income Credit. This part of the EITC Checklist Form ensures that due diligence has been exercised. By accurately answering this question, you bolster your compliance and protect against potential penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.