Loading

Get Ssuta Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ssuta Form online

Filling out the Ssuta Form online can be an easy and efficient process when you know the steps. This guide will provide you with clear instructions on how to complete each section of the form, ensuring that you submit your exemption claim accurately.

Follow the steps to successfully complete the Ssuta Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

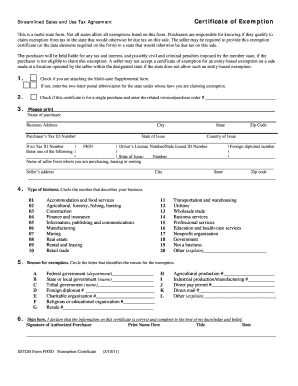

- Begin by checking if you need to attach the Multi-state Supplemental form. If you do not need this attachment, enter the two-letter postal abbreviation for the state under whose laws you are claiming exemption.

- If this certificate is for a single purchase, please enter the corresponding invoice or purchase order number. Then, fill in the name of the purchaser, business address, city, state, and zip code. You must also provide the purchaser's Tax ID Number, state of issue, and country of issue.

- If you do not have a Tax ID Number, you can enter an FEIN, driver’s license number, state-issued ID number, or foreign diplomat number. Ensure that you include the state of issue and the appropriate identification number.

- Provide the name of the seller from whom you are purchasing, leasing, or renting. Include their address, city, state, and zip code.

- Indicate the type of business by circling the number that best describes your business from the provided options.

- Next, you will need to circle the letter that identifies the reason for the exemption from the listed categories.

- Complete the final section by signing the form. The authorized purchaser must declare that the information provided is correct and complete to the best of their knowledge. Include your printed name, title, and the date of signature.

- Once all sections of the form have been completed, you can save your changes, download the completed form, print it for your records, or share it as needed.

Begin completing your documents online today and ensure your exemption claims are processed smoothly.

A saber certificate is not universally mandatory, but it is essential for businesses that wish to make tax-exempt purchases. This certificate provides clarity and compliance with tax laws. Having the appropriate SSUTA Form and saber exemption certificate ensures you avoid unnecessary taxes on qualified transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.