Loading

Get Ssa-766 - Reginfo 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-766 - Reginfo online

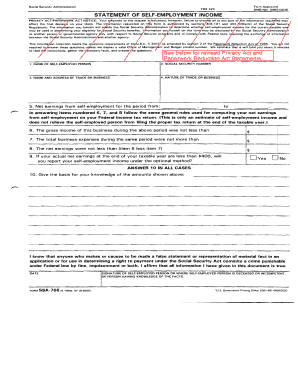

The SSA-766 - Reginfo form is essential for reporting self-employment income to the Social Security Administration. This guide provides detailed instructions on how to fill out the form electronically, ensuring accuracy and compliance.

Follow the steps to complete the form accurately online.

- Click ‘Get Form’ button to obtain the SSA-766 - Reginfo form and open it in your chosen editor.

- Provide your name in the designated field, clearly indicating the self-employed person's full name.

- Enter the social security number of the self-employed individual in the appropriate field.

- Fill in the name and address of the trade or business for which you are reporting income.

- Describe the nature of your trade or business briefly, focusing on the main activities conducted.

- Input the net earnings from self-employment for the taxable period specified. Note the importance of basing this on your Federal income tax return.

- Indicate the gross income of the business during the specified period in the provided field.

- Record the total business expenses incurred over the same period in the corresponding box.

- Calculate the net earnings by subtracting total expenses from gross income and input the resulting figure in the designated field.

- Answer the question about reporting self-employment income under the optional method, selecting 'Yes' or 'No' as applicable.

- Provide the basis for your knowledge regarding the amounts shown above, ensuring clarity and honesty in your statement.

- Finally, date the form and ensure that you sign it appropriately, either as the self-employed person or as someone with knowledge of the facts if applicable.

- Once all fields are completed, save changes, download, print, or share the SSA-766 - Reginfo form as needed.

Complete your SSA-766 - Reginfo form online today for a seamless application process.

If you are reporting self-employment, you will need to contact the SSA office at 1- 800-772-1213 (TTY 800-325-0778). Report your earnings monthly or as directed by Social Security. Reporting methods may differ depending on the type of benefit you receive.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.