Loading

Get Supplement To Form W 8ben Citibank 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Supplement To Form W 8ben Citibank online

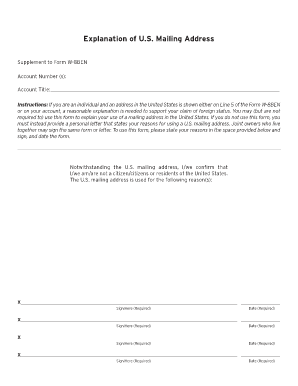

Filling out the Supplement To Form W 8ben Citibank is an essential step for individuals claiming foreign status while using a U.S. mailing address. This guide provides clear, step-by-step instructions on completing each section of the form online, ensuring a smooth and efficient process.

Follow the steps to complete your Supplement To Form W 8ben Citibank online

- Press the ‘Get Form’ button to obtain the form and open it in the preferred platform.

- Locate the 'Account Number(s)' field and enter your relevant account number, ensuring accuracy in the information provided.

- In the 'Account Title' section, input the name associated with the account. This is important for proper identification.

- In the section that follows, provide a clear explanation for using a mailing address in the United States. Be concise and direct, as this helps support your claim of foreign status.

- If applicable, ensure to include signatures for all joint owners who live together in the designated signature lines, each accompanied by the appropriate date.

- After completing the form, review all entries to confirm they are accurate and complete.

- Once verified, save the changes made to the form, and choose an option to either download, print, or share your completed Supplement To Form W 8ben Citibank.

Start filling out your documents online for efficient processing.

The W-8BEN form is used by individual foreign taxpayers, while the W-8BEN-E is specifically for foreign entities. Each form serves to certify tax status for different types of earners. To determine the correct form for your situation, refer to the guidelines available on US Legal Forms and understand how the Supplement To Form W 8ben Citibank fits into your financial needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.