Loading

Get Rmd Correction 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rmd Correction online

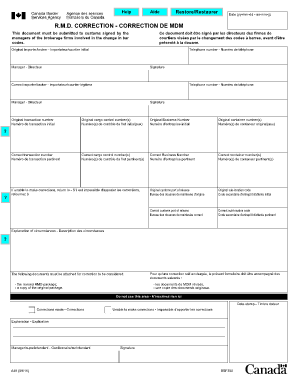

Filling out the Rmd Correction form online is essential for ensuring the accuracy of your customs documentation. This guide provides step-by-step instructions to assist you in completing the form correctly and efficiently.

Follow the steps to complete the Rmd Correction form online.

- Click the ‘Get Form’ button to obtain the Rmd Correction form and open it in your preferred editor.

- Input the original importer/broker information, including the name, telephone number, and signature of the manager responsible.

- Provide the correct importer/broker details in the subsequent fields, entering the necessary name, telephone number, and manager's signature.

- Fill in the original transaction number, original cargo control number(s), original business number, and original container number(s) in the relevant sections.

- Enter the corrected transaction number, relevant cargo control number(s), pertinent business number, and correct container number(s) in the designated fields.

- Specify the original customs port of release and original sub-location code, followed by the correct customs port of release and the correct sub-location code.

- If corrections cannot be made, indicate the circumstances preventing the changes in the explanation field.

- Attach the necessary documents for the correction to be considered, including the revised Rmd package and a copy of the original package.

- Once all fields are completed, make sure to review the accuracy of the information entered before saving your changes.

- You can then download, print, or share the completed form as required.

Start filing your Rmd Correction online today to ensure accurate customs documentation.

The correction window for an RMD typically extends up to the end of the year following the missed RMD. If you miss your RMD, you can make the necessary distribution within this timeframe to avoid penalties. Always document the corrective actions taken during this period as this can support your case in the event of an audit. Using Rmd Correction principles helps you stay on track.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.