Loading

Get Ap 209 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ap 209 online

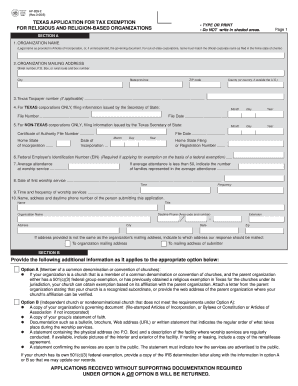

The Ap 209 is an essential application for nonprofit religious organizations seeking tax exemptions in Texas. This guide will assist you through the online process to ensure accurate completion and submission.

Follow the steps to successfully complete the Ap 209 application.

- Click the ‘Get Form’ button to access the document and open it for online editing.

- Begin by entering your organization’s official name as it appears on your governing documents in Section A. Ensure that this matches precisely to avoid discrepancies.

- Enter the mailing address of the organization. Include the street address, city, state, ZIP code, and county (or country if outside the U.S.).

- Provide the Texas taxpayer number if applicable. If your organization is a Texas corporation, include the required filing information issued by the Secretary of State, such as the file number and incorporation date.

- If your organization is a non-Texas corporation, fill in the home state of incorporation and the registration number, along with the date of filing.

- Input your Federal Employer's Identification Number (EIN) if your application is based on a federal exemption.

- Indicate the average attendance at worship services. If attendance is less than 50, note the number of families represented.

- Document the date of the organization's first worship service and provide details regarding the time and frequency of worship services.

- Fill in the contact information of the person submitting the application, including their name, title, organization name, daytime phone number, and address.

- Complete Section B by selecting the appropriate option for your organization and providing the necessary supporting documentation as required.

- Review all entries for accuracy and completeness, ensuring that all required fields are filled out and documents are attached.

- Finally, save your form, then either download, print, or share the completed application form as necessary.

Start your application process online today to secure your organization's tax exemption.

To file for property tax exemption in Texas, you must complete the appropriate application form, which is usually available through your local appraisal district. Prepare necessary documents that demonstrate eligibility according to the Ap 209 requirements, such as financial statements or proof of non-profit status. Utilizing uslegalforms can streamline this process, offering forms and guidance tailored to your specific exemption needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.