Get Onett Computation Sheet Excel

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Onett Computation Sheet Excel online

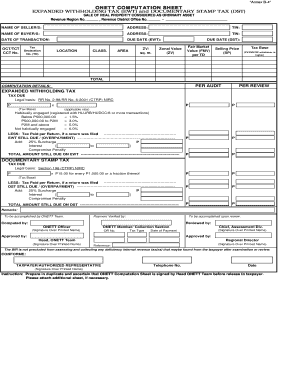

The Onett Computation Sheet Excel is a crucial document for reporting expanded withholding tax and documentary stamp tax related to the sale of real property considered as an ordinary asset. This guide will provide you with clear, step-by-step instructions to help you accurately complete the form online.

Follow the steps to successfully fill out the Onett Computation Sheet Excel.

- Click the ‘Get Form’ button to obtain the Onett Computation Sheet Excel document and open it in the editor.

- In the 'Name of seller/s' field, enter the full name of the person or entity selling the property. Ensure accuracy for legal identification.

- Fill in the 'Address' of the seller. This information helps in proper communication and documentation.

- Provide the 'Tax Identification Number (TIN)' for the seller. This number is essential for tax purposes.

- Repeat the previous steps for the 'Name of buyers', including their address and TIN, ensuring all details are accurately captured.

- Enter the 'Date of transaction' to reflect when the sale occurred. This date is crucial for tax reporting.

- Fill out the 'Due date (EWT)' field, indicating the deadline for the expanded withholding tax payment.

- Complete the property details such as 'OCT/TCT', 'CCT No.', and 'Tax Declaration No. (TD)' to identify the specific property involved in the transaction.

- Provide the property's 'Location', 'Class', 'Zonal Value (ZV)', 'Area', and other relevant details in the respective fields.

- Calculate and enter the 'Fair Market Value (FMV) per TD', 'Selling Price (SP)', and determine the 'Tax Base' which is the highest of ZV, FMV, or SP.

- Follow the instructions for the Expanded Withholding Tax (EWT) section, including computing the tax due based on provided legal bases and applicable rates.

- Fill out the Documentary Stamp Tax (DST) section, calculating the tax due based on the guidelines and providing any tax already paid.

- Input any applicable penalties or surcharges as outlined, ensuring correct calculations to avoid discrepancies.

- Review all entries for accuracy and completeness before proceeding to save changes. You may then choose to download, print, or share the completed form.

Complete your Onett Computation Sheet Excel online today for accurate tax reporting and compliance.

The name Onett is often associated with clarity and structure, making it suitable for tools that assist with calculations. In the context of tax and finance, it implies a methodical approach to managing complex figures. By utilizing the Onett Computation Sheet Excel, users benefit from a clear and efficient system that simplifies their tax computations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.