Get Charles Schwab W8ben 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Charles Schwab W8ben online

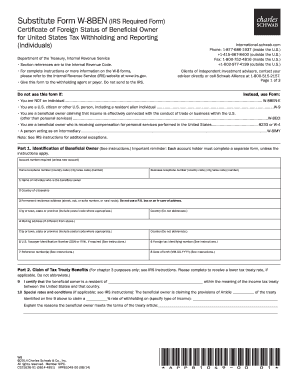

Filling out the Charles Schwab W8ben form online can seem daunting, but with clear guidance, it can be a straightforward process. This form is essential for foreign individuals to establish their foreign status and claim beneficial ownership of income, potentially qualifying for a reduced withholding rate.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part 1, Line 1, enter your name as it appears on your official documents. If you are the single owner of a disregarded entity, provide the name accordingly.

- In Line 2, indicate your country of citizenship. If you hold dual citizenship, select the country where you are currently a resident.

- For Line 3, input your permanent residence address. It should reflect your actual residence for tax purposes, and do not use a P.O. box or financial institution address.

- If applicable, provide a mailing address in Line 4, only if it differs from your permanent residence address.

- In Line 5, enter your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) if you have one. If not, acknowledge that you are ineligible.

- Line 6 requires a Foreign Tax Identifying Number (TIN) from your country unless you do not have one.

- For Line 7, if the account is in the name of a disregarded entity, include both the name and account number here.

- In Line 8, provide your date of birth in the MM-DD-YYYY format.

- In Part 2, Line 9, state the country where you reside for income tax treaty purposes. Ensure that this matches the country listed in your residency claim.

- Line 10 is for those claiming treaty benefits. Specify the article number, the tax rate, and the type of income you're expecting to receive under that treaty.

- After double-checking all the provided information, complete the certification in Part 3 by signing and dating the form.

- Lastly, save the form. You can download, print, or share it as needed, then return it to Schwab via email, fax, or mail as per their instructions.

Begin filling out your Charles Schwab W8ben form online to ensure compliance and secure your tax benefits.

Yes, you must report your 1099-B on your tax return, as it contains information regarding your capital gains and losses. This reporting is essential for accurately reflecting your income on your tax forms. Failure to report could lead to penalties, so ensure that you include all relevant details from your 1099-B. If you have filed a Charles Schwab W8ben form, be sure to consider any tax treaty benefits that may apply.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.